When getting ready to have a baby, life insurance is definitely on the list of things to take care of. So the question is “can I get life insurance if I’m pregnant?” The short answer is yes you can. You can even do so at favorable rates, under certain circumstances. So let’s discuss those in short at first and then dive into detail.

When getting ready to have a baby, life insurance is definitely on the list of things to take care of. So the question is “can I get life insurance if I’m pregnant?” The short answer is yes you can. You can even do so at favorable rates, under certain circumstances. So let’s discuss those in short at first and then dive into detail.

In summary, you can get life insurance at preferred rates if you’re pregnant and complication free. Most of this will depend on which company is most favorable for pregnant applicants. Some companies decline pregnancy all together so it’s not recommended you do your shopping on a quote engine if you’re already carrying. In this case, the best quote on the quote engine isn’t the best quote for you. Your best option is to call us so we can do the shopping for you and put you with the company that will approve you at preferred rates.

Otherwise, let’s look at a quick summary of things that will affect your life insurance application with certain companies.

Those factors include:

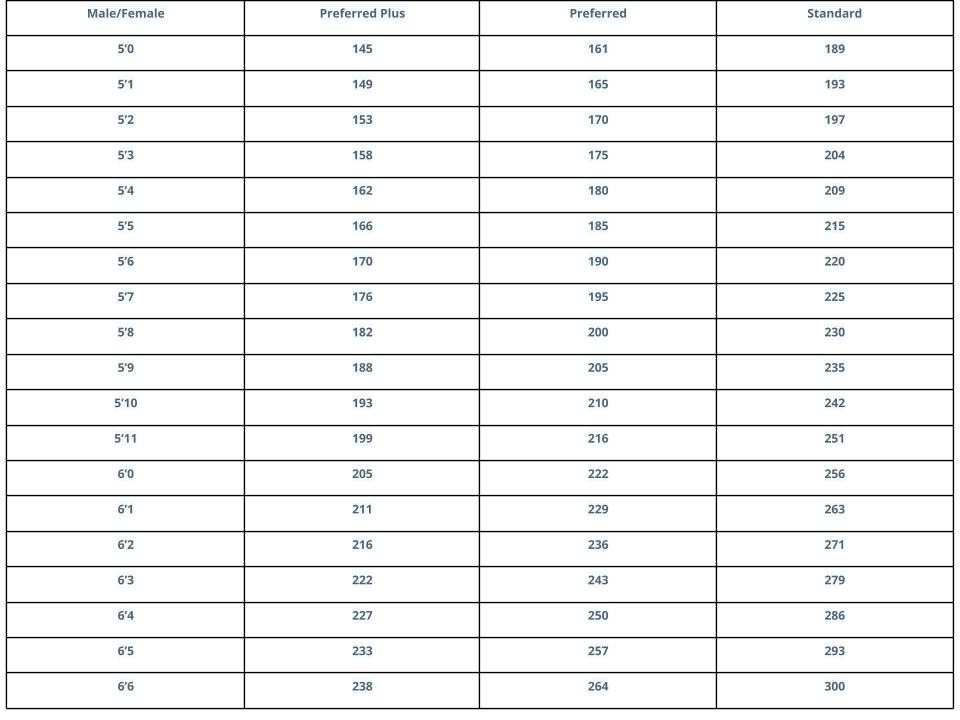

1. Your Weight – Life insurance companies won’t give you a break for the baby weight if you don’t fit into the ideal, non-pregnant, build table(height/weight). However, if you do get a higher rate for your weight we can ask the company to reconsider the rate after 12 months of you being at your lower weight.

2. Complications – Some companies will either rate you up or decline you all together for complications such as:

- Gestational diabetes

- Eclampsia

- Pre-Eclampsia

3. Overall Health – any other health issues that were present before the pregnancy will also affect your rate or approval.

Let’s discuss these in detail and weigh out the best and worst case scenario.

What Companies Take Into Consideration

Overall, getting life insurance while pregnant isn’t a big issue because it’s an absolutely natural process in our lives. However, the concern for companies becomes if there are any complications associated with the pregnancy. Life insurance companies like to avoid risk so where there is potential for risk, there is a higher rate or decline associated with the applicant.

The Weight

You would think life insurance companies would give you a break for your weight when you’re carrying another living being inside you, but they don’t. The extra weight you gain is absolutely black and white when it comes to the underwriting portion of your application. Also considering most women don’t hold back on eating their favorite foods in unreasonable proportions during pregnancy(OK I’m assuming, but you know its true). This can result in the excess baby weight that affects your life insurance premiums. For this reason, it’s best to get your life insurance early in your pregnancy, or after, if you already have some coverage in force. Also, I’m willing to risk my life and send you to our “Life Insurance if You’re Overweight” article to learn more. Otherwise, you can take a quick glance at this build chart to see where you’ll end up.

Gestational Diabetes

If you have gestational diabetes accompanying your pregnancy then you have a possibility for a standard rate if this is the standalone issue. This can be either during or post pregnancy, but the companies are much more lenient post pregnancy. If you didn’t get any other form of diabetes after the pregnancy there is a company that will approve you at preferred rates. You can learn more about life insurance with Gestational Diabetes here. Most other carriers will give you a higher rating even though you no longer have gestational diabetes, so working with the right company is crucial.

Other Complications

Whether you have Pre-eclampsia(Toxemia) or Eclampsia you most likely will get either declined or receive substandard rates by most companies. In this case, they usually want to see all symptoms dissipate before providing you with preferred rates. So your options would be to either wait till it goes away, or pay a little more for coverage now until complications reside, and then ask the company to reconsider or re-apply. Like stated before is best to get life insurance before or right at the beginning of your pregnancy!

Best Case Scenario

The best case scenario is that you are pregnant with no complications. At this point, you can get preferred rates as long as your height and weight checks out. If this applies to you then you can go ahead and apply for a term life with an exam or a quicker no exam option.

Worst Case

Worst case is you get a decline at which point you would have to wait till delivery to see if the complications reside to get coverage. Your best course of action is to work with an independent agency like ours that knows which company to turn to in the event of a pregnancy to get an approval for coverage at least at a substandard rate. So feel free to email, call or chat us for more assistance.

Do I Need the Coverage?

Whether you are or aren’t the major provider of income in the household you should still have coverage in place to be able to replace your responsibilities. Whether it’s your 1st child or 5th you’d want your kids to be okay if anything were to happen to you so it’s extremely important to have adequate coverage. So if you already have a policy in place then you may get away with waiting but if you don’t, I’d recommend getting something you can afford comfortably now.

Getting the Right Amount of Life Insurance

When welcoming a new child or children to your family having an adequate amount of coverage is crucial. That’s why we recommend doing a thorough needs analysis which once complete will show you exactly how much life insurance you’ll need to have. The number of new parents that are under insured is really high and the cost of a term policy is very affordable. Typical needs analysis is performed by your agent and if they don’t do one then you shouldn’t be working with them in the first place. The needs analysis focuses on things like your mortgage balance, credit card debt, student loans, all your assets, the number of beneficiaries and after death planning. Besides getting the right amount you also need to get the right length of coverage to secure your family for the vital years.

Wrapping Up

Most brokers would tell you that if you’re pregnant you can “get life insurance no problem.” That, however, is not always true. As you learned here, various things go into reviewing your application for coverage. The best bet is to contact us so that we can do a full needs analysis, ask you some health questions and then determine which company will offer the best product, at the best rate, for your specific situation. Getting life insurance can be very simple so give us a call or look at plans with one of our quote engines, we work with over 60 carriers top rated carriers!