Life insurance can be a tough subject to approach for any typical civilian. It can be even more difficult if you are considered a high risk by the life insurance companies. If you are an offshore oil rig worker, then you are already well aware that your job isn’t all peaches and cream. You’re always working long hours and almost always surrounded by heavy machinery that puts your life and health at risk on a daily basis. Oil rig workers make the cut for having the “most dangerous job in the U.S” every year, so it can be easy to understand the questions surrounding life insurance. So can you get life insurance as an oil rig worker. The short answer is, yes, you can. Let’s talk about life insurance for oil rig workers in detail.

Offshore Oil Rig Workers and Life Insurance Rates

So we’ve identified that you CAN get life insurance as an oil rig worker, but at what cost? Life insurance companies have health classes broke down by the risk associated with insuring you. The risk can be bad health, or in this case, a dangerous occupation. The absolute best rate you can get is Preferred Plus, followed by Preferred, Standard Plus, and Standard. If you’re really ill, you will fall into a whole other Substandard category.

Because of the danger associated with the job you will not always be able to qualify for the typical preferred or preferred plus life insurance rates that your white collar comrades can qualify for. Typically, you can qualify for a Standard Plus rating, with a $2.50 – $5.00 flat extra. An extra what?

A flat extra is an extra surcharge per $1,000 worth of life insurance coverage. The amount of the flat extra will depend on the type of job you possess. So let’s say you want $500,000 worth of life insurance coverage and your flat extra is $5. This means that you have to pay an annual flat extra of $2,500 on top of your annual life insurance premium.

Sample Quote

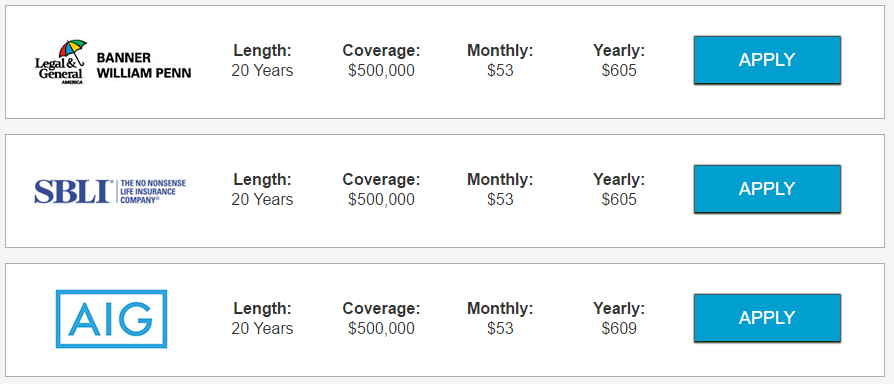

So let’s take everything in consideration all of this news and run a quote for a 40-year-old, non-smoker, male that is an offshore oil rig worker. Keep in mind this is given that his health is in check and all other factors check out fine. The quote will be for a $500,000 20-year term life insurance policy. Here are the results.

Standard Plus Quote:

So as you can see the annual rate comes out to $605 with the most competitive carrier. Now let’s add the flat extra of $5.00.

$500,000 worth of coverage, which means $5 per thousand. This means 500 x 5 = $2,500. To get the total annual rate we add $2,500 to $605.

Final quote: $3,105

As you can see you do pay for your risk handsomely, however you do get a big break considering the dangers of the job. Keep in mind that depending on your job or the company you apply with you can qualify for a lower flat extra rate.

Why Do I Have to Pay for the Flat Extra?

Life insurance companies determine rates by the risk you possess. The risk is associated with your death. That means the higher chance of you dying through illness, age, or dangerous occupation, the higher your rate. And according to this article in time magazine, working on an oil rig brings its fair share of dangers. The way to get the best rate is to work with an agent knowledgeable in this so that they can recommend the company that will insure your risk at the best rate. Just because company A came in with the lowest rate on the quote engine, doesn’t meant company B won’t offer better standard plus rates for oil rig workers by offering a smaller flat extra. This is why working with an experienced independent agent is important.

Coverage Types to Consider

When it comes to life insurance there are several types of coverage you can opt for. Because oil rig workers make an average of $50,000 to $80,000 a year, we will focus on pure protection life insurance and steer clear of cash value.

Term Life Insurance

A term life insurance policy is a life insurance policy that comes with an expiration date. If you buy a 20-year term policy your rate will be locked in for 20 years and will not go up or down. This is known as level term life insurance. Once the 20 years is up you will have an option to convert the policy to a permanent one without proof of good health. Your rate will simply be adjusted to your new age. Term life insurance is ideal for what are often deemed the “critical” years of financial responsibility. This can include things like income replacement for a spouse, mortgage payment, or college expenses for the kids. If you still have a need for life insurance after the term period, then you can always convert your policy. Make sure the term policy your agent offers you comes with an Option to Convert.

Guaranteed Universal Life (Permanent Term)

A Guaranteed Universal Life policy(GUL) is a life insurance product that is designed to provide pure protection for the entire life of the applicant. It’s often called permanent term due to its simplicity, and the fact that it technically comes with an expiration date. Most GUL policies range between coverage to age 90 or 121. It has very little cash value, which is used to keep the level premium rather than provide hefty returns. This is the most affordable permanent life insurance option on the market.

No Medical Exam

There are policies out there called no medical exam or simplified issue life insurance. If you are fairly healthy and need coverage, then these policies are ideal. You can get coverage in as little as a few hours or a few days with up to$400,000 in coverage. In rare cases you can qualify for $1,000,000 with no exam. The pitfalls are that the convenience comes with a price tag and cap on coverage amount.

The Process

The life insurance process usually consists of a few very simple steps. Here are they are in order.

- Pre-qualification – this is the part where your agent will ask you about your occupation and health history to determine which company will be the best fit. You will be asked about your job duties, hours worked, and location of employment. The agent will then use this information to shop for the best rate. If your agent is not diligent in this process, it’s a sign you’re working with a rookie.

- Application – once the agent has identified the best company for your specific situation, it’s time to do the application. The application will consist of your personal information like driver license number and address. You will also be re asked the health questions and you can set up your beneficiaries. You will schedule the medical exam at this time.

- The Medical Exam – the medical exam will take place a time and place of your choosing unless you opted for no exam coverage. It runs like a physical along with a blood and urine sample. The nurse will ask you a few health questions and you will be good to go in about 30 minutes.

- Underwriting – this is the part where you don’t have to do anything. The life insurance company will take all of this information and review it. They will also look into the Medical Information Bureau and dig up some old records to make sure what you say is true. This can take a few weeks and your agent will get word once you’re approved.

- Approval – the entire process can take 6 to 8 weeks and once you are approved your agent will let you know by phone. After you can expect to receive your policy in the mail to sign the delivery requirement. You will have a “free look” period to determine if this policy is the right fit for you. If you choose not to move forward, you will not be charged.

If not made obvious by now, there are a lot of important steps to take when getting life insurance as an oil rig worker. That is why it is an absolute must that your agent is:

- Knowledgeable

- Independent

The independent status allows the agent to compare all the companies on your behalf to get you the best rate. The knowledge, well that’s the part that actually gets you the best rate.

Start Here

The good news is that you have reached your destination. We are an independent life insurance agency that has many years of experience working with offshore oil rig worker. We do all the shopping on your behalf to insure that you get the bet rate out there. The best part is we do this at no extra cost to you! If you have any questions about life insurance as an offshore oil rig worker, then give us a call at 888-492-1967 or hit the chat button below. Welcome to InsureChance!