Term life insurance and Whole Life insurance have been debated since their existence by financial experts and rookies alike, with both teams cheering for both products. So if the experts can’t make their mind up, how is the customer supposed to do it? Isn’t that what professionals are for after all? Well, in the end the choice is yours. Life insurance agents and financial advisors are there to explain the products, answer all your questions and recommend the best course of action. But like anything in life, the final decision is yours to make. So I’m going to use this article to tackle this debate head on, and to help you, the consumer, make an educated decision on whether you need whole life, term life, or something else.

What’s the Difference?

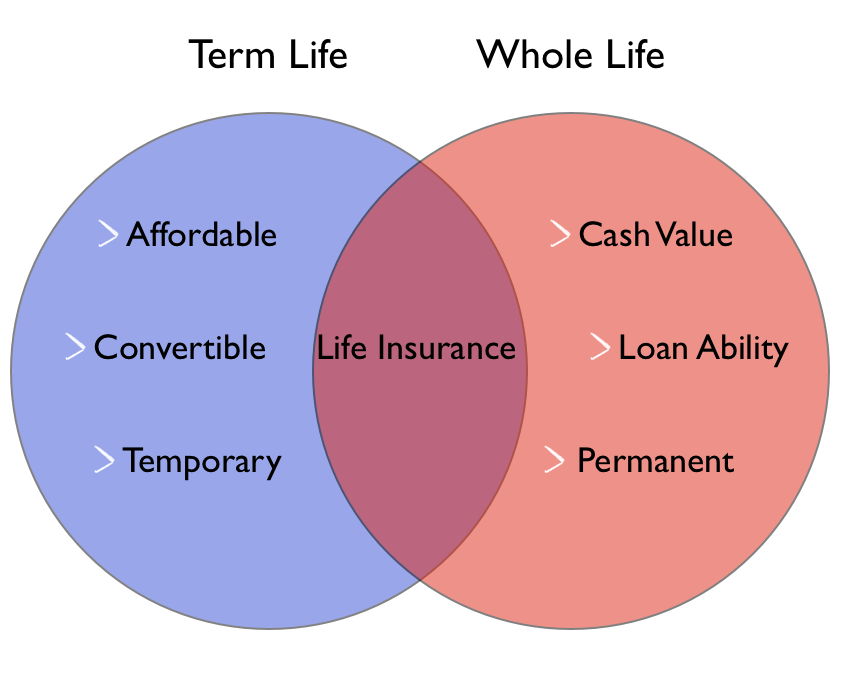

The main difference is in the name, seriously, I’m being sincere. Term life is life insurance coverage for a given “term” of your life. And whole life is a life insurance coverage for your, you guessed it, WHOLE life. Now from just reading that you would think “well its obvious whole life makes more sense, right?” Not exactly. Let’s go over their major differences in detail.

Length of Coverage

Whole life insurance is a permanent life insurance product that will provide financial protection to your loved ones in the case of your passing as long as you maintain your premiums, usually to age 100. At which point your policy will be paid up. Term life insurance however, is not a permanent life insurance product. This is a life insurance policy that comes with an expiration date. You can attain a term life policy for 10, 20, 30 and sometimes 40 years. Once the policy is in force you pay a locked in rate for the set amount of years you pick. Once the term expires, so does the policy and you no longer have protection. Unless you renew or convert it(more on that in a bit).

This is the most discussed difference between the two policies, but, for the most part, the most irrelevant. Why? Two big reasons:

- Whole life is not the only permanent life insurance product on the market. There are much more affordable alternatives in the form of Guaranteed Universal Life Insurance policies, often called “Permanent Term.” These products don’t have a strong investment aspect as Whole Life(more on that in a bit) but they do offer permanent protection to old age. Often to age 100 or 121 before they expire, which is why they are called permanent term. If you live longer than that don’t be bummed, you’re breaking world records.

- Term Life Insurance can be converted to a permanent product, on a guaranteed basis. This means that you can convert your term life insurance policy to a permanent life insurance once the policy expires or prior to age 65(70 in some cases). You also would not have to prove good health. For example, let’s say Joe got a 20 year life insurance policy at a very healthy rate at 35 years of age. Now 20 years pass and his policy is due to expire and unfortunately he was diagnosed with type 1 diabetes in the interim. Normally a diabetic would get rated up or declined for coverage. But because Joe is going to exercise the conversion privilege that comes with a good Term Life policy, he will get permanent coverage in place at the same health class as when he was 35. The only thing that would be adjusted is his rate for his new age of 55. You can also renew the coverage annually but that can get too expensive over time.

Cash Value

The second major difference is the world famous “cash value accumulation.” Whole life insurance is a life insurance policy that comes with an investment aspect that uses a portion of your premiums that accrue the cash value over the years of the policy. The more time goes by the more cash value your policy accumulates and you will be able to “borrow” funds against the policy. The borrow is quoted because technically it’s a loan. According to most financial advisors this is a GREAT investment. I say this is a GREAT investment if: you’re rich, you’re not considered as part of the middle class, you don’t actually need life insurance, and you “maximized all your good investments,” which, if you ask me, you can never really maximize a good investment can you? It’s just something cool term life insurance agents have learned to say to avoid bashing whole life all together. This is because there are some very rare instances where whole life can make sense, very rare. Term life insurance, does not carry cash value accumulation, it’s simply a pure death protection life insurance product.

Cost

Here’s where it becomes easy to determine if you’re the type of consumer who needs Term Life or Whole Life. If this heading was irrelevant to you because cost is no thing in your life, then whole life may be for you. But if you have a legitimate fear that your financial dependents would be devastated if you passed and you need an adequate coverage amount in the coming years to secure your loved ones at an affordable rate, then term life insurance is for you. Whole life can be as much as 10 times the cost of a term life policy, for the same exact amount of coverage. This is due to the many fees associated with a whole life product and largely due to the cash value accumulation. However, I always stress that life insurance should be attained with the assumption that you can pass away at any time, so you should focus more on protection rather than investing if your death is a financial disaster to your family. Besides, there’s a lot of investing you can do with the money you save if that is your desire(more on that in a bit).

For those feeling nostalgic about 3rd grade, here’s a quick breakdown:

In my ongoing attempt to help you understand the difference. Let’s breakdown the pros and cons of each product.

Term Life Insurance Pros and Cons

Like any product, from smart phones to broomsticks, all products come with their share of pros and cons, term life insurance is no exclusion.

The Good Things

For the most part it’s fairly obvious what term has to offer as a product: it’s affordable, it’s simple, and it can be turned to a permanent policy without having to prove good health.

- Affordability – term life insurance is hands down the most affordable product on the market. It’s designed to protect you during the most pivotal years of your life. This includes things like paying a mortgage, kids you’d like to attend college, and income replacement for your dependents. These are viewed as temporary financial responsibilities and term is best at the point in life where life insurance is obviously detrimental. But why is it so affordable? Because this is “if” you die coverage, where as permanent life insurance is more “when” you die coverage. So its possible that you die, its just not likely, and based on that you get affordable rates. The higher chance of you dying, the higher your rate for life insurance. How affordable is it? Well a healthy 35 year old male who doest smoke can get $500,000 worth of coverage, for 20 years, for $31 a month. Thats about a dollar a day.

- It’s Simple – this isn’t too much to celebrate but it is a pro nonetheless. For people who don’t want to hear about cash value, tax advantages and potential gains, term life insurance is a perfect, pure protection, life insurance product. If all you want to know is what your family will receive when you die and what you need to pay for it, term life provides that simplicity.

- Convertible – that’s right, let the top down and enjoy the sun up, because term life insurance comes with a convertible option. As mentioned earlier this means that at the policies expiration you can turn it into a permanent life insurance product. Even if you paid off your mortgage and your kids are all grown up, you can still convert and lower the coverage amount to your now lesser need for life insurance and leave it to cover any final expenses that maybe associated with your death down the line. This way the age adjustment doesn’t skyrocket your rates. The option to convert usually comes as an add on to the policy at NO extra cost. Most financial advisors frown on term life agents that sell term life policies without this option, and rightfully so. To avoid this always make sure the product you’re being offered contains this option. If not, run from that agent.

The Downfalls

So that was the good stuff, let’s talk about the not so good stuff.

- It Expires – a lot like that milk in your fridge that went bad when you went gluten free for that one month and stopped eating cereal, term life insurance policies expire. While the convertible option is a fix to this problem, there is no changing the fact that there will in fact be an increase in premium at the end of the policy to adjust to your new, older, more senile age. Of course you may not need as much coverage, but still, it does expire. Also, if you already have a term life policy in place and worked with a rookie agent, then you may lack the convertible option. In which case this would be a huge downfall of that particular product.

- Has Cash, Has Value, but Doesn’t have Cash Value – don’t expect your term life insurance policy to come with an investment aspect. That’s what whole life insurance is for. The benefits that come with term life insurance are locked in rates and some living benefits like the Accelerated Death Benefit Rider.

No that’s just about it for the pros and cons of term life insurance, so, whats good and bad with whole life insurance? Let’s get into it.

Whole Life Insurance Pros and Cons

So we talked up term and talked it down a little, let’s talk about Whole Life Insurance. The good, the bad, and the ugly of this cash value accumulating, tax sheltering, permanent protection, life insurance insurance policy.

The Good Things

The best things about whole life insurance are not for everyone. But let’s talk about what makes this a good product.

- It is truly for your whole life – given that you can pay your bills consistently and on time, whole life Insurance is a product designed to provide life insurance protection for your entire life. This means no expiration dates at any point. Most whole life Policies mature at age 100. This means that the cash value accumulation equals the death benefit and now your death benefit is yours to do with as you please. The premium will also remain level throughout the whole policy.

- Has Cash Value Accumulation – even though whole life is super expensive because of this, it does come with an investment aspect called cash value accumulation. This can make sense for someone doing estate planning, or can pay up the whole policy up front to reap the benefits of the interest earned on premium sooner rather than later. The cash value is considered a tax sheltered investment.

Cons

The cons for whole life come from the fact that it isn’t for the average folk that are part of the middle to lower middle class.

1. It’s Expensive – now while “expensive” may be relative, let’s illustrate the difference in cost between whole and term life. Let’s run a quote for a $250,000 whole life and term life policy with Sagicor for a 35 year old male at a Preferred health rating. Here are the results.

Whole life – $256 a month

10 year term – $20 a month

20 year term – $27 a month

Now you can see why a many agents advise that you “buy term and invest the rest.” That’s a huge difference in premium and if cost is an issue it’s better to focus on adequate life insurance coverage rather then lure of investment. Keep in mind both of the term life insurance policies above are convertible policies.

2. Not the best investment – when it comes to whole life as an investment its a great way out for someone who doesn’t want to take a little time to learn about other investment options. But if you’re serious about investing a whole life insurance policy should be your last resort because historically their returns are much lower than most investments out there. Once again, its a very particular type of client who benefits from this type of life insurance, and its usually not the type of client who absolutely needs life insurance.

Whole Life: Not Always a Great Investment

From a perspective of obtaining insurance and an investment, whole life does not make a lot of sense for an investment opportunity or service as life insurance. Many people don’t need coverage for their entire life and if they do there are more affordable options without the investment portion, but yet that continues to be what draws people in to purchase whole life. However, there are much better options available if investment is what you’re seeking. Here’s why:

Illustrated whole life returns are not guaranteed, whole life insurance is not diversified, and positive returns in a whole life insurance policy take a long time to actually come to fruition. An advisor trying to sell you a whole life policy may paint the potential for return as rather large, the reality is that policies held for 40 years or so will have returns of around 4%(a lot less if you try to cash out earlier). Although this may not seem like a generally bad return, a 10-year treasury bond will return 5.4% historically. Which is good, but even still, not the best ROI out there. In comparison to most investments, the whole life insurance investment component just doesn’t measure up.

An investment in stocks or real estate will depend on many different factors but over the course of several decades, you could be looking at potential returns between the 7% and 12% range. When comparing these various options such as real estate, stocks and treasury bonds, you can see that whole life insurance doesn’t make much sense as an investment.

Advisors who may be attempting to sell you a whole life policy will show you projections of possible returns but you should never count on these as guaranteed. They’re frequently presented in the most positive light possible to entice you to purchase the policy. Don’t get me wrong, I’m not saying all advisors are out for themselves, some of them have just been taught that this is the way to go. So the best thing to do is to sit down, do the math and the research yourself and THEN go find a professional to work with. In the end, if investment is your bottom line, there are other routes you can take that provide better returns that come without the expensive premiums and high fees associated with a whole life insurance policy. In my humble opinion, your money is better finding it’s way to a term policy followed by index funds, REITS, bonds, etc.

What Everyone Else is Saying

As we travel through this post together it can be easy to think that I’m leaning towards term life as the product for you but that will depend largely on who YOU are. Both products have something for everyone, but based on my opinion, which is based on statistics I’ve come by, many more people can benefit from term life insurance. But who cares what I have to say! Let’s hear what some smart, well respected folks out there are saying.

Jeff Rose

Certified Financial Planner(CFP) Founder of Alliance Wealth Management LLC, founder of GoodFinancialCents.com and Author of Soldier of Finance

Jeff Rose is one of the first customer oriented “online life insurance agents” and has been educating consumers online for about a decade regarding life insurance and finances. As a life insurance agent and financial advisor, it would make sense for his pocket to offer Whole Life policies, except that’s not Jeff’s way. Jeff has been vocal about his disdain for other advisors who push whole life in cases where it’s really not necessary. Here’s a few quotes from some of his posts across the web.

Here’s an excerpt from his Daily Finance article:

This drives a very clear point that Whole Life isn’t really the best idea for those that are looking for life insurance. The cost vs value per death benefit just doesn’t make sense.

He continues with another point:

Yes it does take that long to build up cash value and sometimes even longer. This is why Jeff Rose suggests the famous, world renowned, and often quoted advice by the rational advisor:

It’s hard to imagine what the pro whole life crowd gets so angry about when they hear things like this. It’s not like we’re saying whole life is bad, we’re just saying “Hey, here’s is a MUCH better alternative.” Both for life insurance and investing.

James M. Dahle

MD, FACEP – Author of “White Coat Investor”

James is one of the many voices out there educating people on why whole life insurance isn’t for everyone. What are his reasons? It’s a poor investment. Many doctors get offered whole life by their advisors and James seems to be on a mission to prevent this from happening. Through his own thorough research and knowledge on investing he breaks down why whole life isn’t a good investment strategy. James discusses the many myths of whole life insurance and in this post he talks about why whole life isn’t the best permanent life insurance option out there and why it can be a poor investment. The quote from this article is as follows:

He goes on to say:

Right James, but what’s the alternative? Well it looks like he’s thought of that too:

Thank you James for the undeniable logic. This is a common point made and rightfully so, why pay more to invest less when you can invest more?

Neal Frankle

Certified Financial Planner, Registered Investment Advisor, Founder of WealthPilgrim.com

Neal Frankle is an advisor that has used his platform on WealthPirlgrim.com to teach people about life insurance in a simple way and is there to provide the services for them if needed. With a lot of knowledge and years of experience, Neal Breaks down Term vs Whole life insurance in a very simple fashion. Here’s what he says:

So Neal, why would you buy whole life?

It doesn’t get simpler than that, now either we’re on to something here or we’re all crazy. Personally I would trust the people who have been in the industry for years and are telling you NOT to by a product that would financially benefit them. Thank you Neal for being one of the good ones.

Leslie Scism

News Editor, The Wallstreet Journal

According to her bio, Leslie Scism has been contributing to the Money & Investing section of the Wallstreet Journal since 1993. She returned to her reporting years during the 2008 financial crisis and turned her focus to life and property-casualty insurance. In her very popular post about whole life Insurance “Life policies: The Whole Truth” Leslie breaks down why “Many people aren’t good candidates for whole life.”

There are a few points made about the tax advantages of whole life and potential dividend payouts but the biggest eye opener of the article is the data:

There’s been advisors that compare this to people defaulting on their car and home loans, except not only do you use your car and your home in the interim, but it’s a living necessity, unlike throwing money away for and overpriced investment product. Another point made in the article by James Hunt is how long it takes to build up the cash value for it to make sense.

Kathy Kristoff

Finance Columnist, Author “Investing 101”

Kathy Kristoff is a well respected personal finance columnist for the Los Angeles times and is the author of an excellent read in “Investing 101.” In that book she offers great investing advice and breaks down the best investments for different life scenarios. When discussing the risk of death, naturally the topic of life insurance came up and this is what she had to say, directly quoted from the book:

Yes Kathy! That’s exactly right and kudos to you for educating the good folks out there on just how affordable term life insurance can be. Now being an expert on investing, Kathy had to add another disclaimer that I’m sure at this point you can see coming, here’s what she had to say about life insurance as an investment:

Whew! So I’m not the only one! The trend here is getting painfully obvious: people educated in investments don’t think whole life makes for a good one and some of us would actually be compensated well for selling it to you.

All that being said, here’s what I think.

My Thoughts – Sean Dudayev

CCO(Certified Captain Obvious), Co-Founder of InsureChance.com

For this I’ll tear my shirt off so you can see the CO on my chest and put on my cape, Captain Obvious is coming to the rescue. As I’ve said many times before, whole life Insurance isn’t for those that actually need life insurance. You get life insurance with the assumption that you have no idea when you will die, you may live till 100(congrats) or you may die next week(sorry). This is why it’s hard for me to wrap my head around a life insurance agent that can sit across from a couple who brings in median household income and sell them a whole life policy for $50,000 because that’s the only death benefit amount they can afford, all because he thinks it’s a “good investment.” What would the surviving spouse do with that 50k if their significant other was to pass away in a year? That’s when these brilliant advisors say you should “stack it with a term life insurance policy.” So the logic is: because whole life doesn’t provide enough coverage(because its so expensive) then we should add more coverage with term. So then, why even pay for the life insurance portion of the whole life policy? Can’t you invest that money yourself? Can’t you, in fact, bypass all the fees and agent commissions and invest it better? Yes, in fact, you can, and you should. Majority of the middle class should do without a whole life policy and enjoy the low premium benefits of term life insurance and it’s conversion privileges for later in life. If you’re looking for guaranteed, tax sheltered investments, there are other options for you. In closing, whole life insurance isn’t for those that actually need life insurance the most, it’s for those who are running out of ideas of what to do with their money.

And the Winner Is…

Surprisingly, despite the tone of the article, it still does depend on who you are. In the end the decision is yours to make. Just keep in mind if your family will be left in a financial hell storm through your passing, then you’re better off sticking to a term life insurance policy. In almost all cases, it’s better to buy term and invest the difference. If you find it hard to come up with “the difference” then definitely stay away from whole life and do whatever you can to secure adequate life insurance coverage through a term life insurance or guaranteed universal life(permanent term) insurance policy.

Hopefully I did justice with this post and helped clarify term life, whole life and the biggest differences between them. If you have any further questions feel free to contact us today and we will be happy to answer them for you. If there is something you think I missed please drop me a comment below and I’ll be glad to address it. Now, given the highly sensitive nature of this topic please keep your comments respectful if you hope for them to be approved. Other than that, a healthy debate is always fun. Welcome to InsureChance!