Welcome to InsureChance, the first online life insurance marketplace! If you are on this page right now you deserve congratulations! Not many people understand the importance of life insurance and it’s refreshing to know that you are here trying to protect your family’s financials! You have made the conscious decision of buying life insurance but you are probably wondering if a $10 million dollar life insurance policy is the way to go or not and we are here to help you figure it out! One of the first questions you will be asked when you tell your agent you want to buy life insurance will be, how much coverage are you looking to buy? Don’t panic, we are here to ease your stress! In this article, we will be discussing whether or not a $10 million dollar policy is enough, the life insurance process, and how to know if it’s enough. The following are some key points from this article:

Welcome to InsureChance, the first online life insurance marketplace! If you are on this page right now you deserve congratulations! Not many people understand the importance of life insurance and it’s refreshing to know that you are here trying to protect your family’s financials! You have made the conscious decision of buying life insurance but you are probably wondering if a $10 million dollar life insurance policy is the way to go or not and we are here to help you figure it out! One of the first questions you will be asked when you tell your agent you want to buy life insurance will be, how much coverage are you looking to buy? Don’t panic, we are here to ease your stress! In this article, we will be discussing whether or not a $10 million dollar policy is enough, the life insurance process, and how to know if it’s enough. The following are some key points from this article:

Quick summary:

- The application process for $10 million dollar policy is no different from any other application.

- After age 40 the company may request additional testing with the traditional medical exam.

- There are two types of coverage options you can get which are term plans and permanent life insurance plans.

- Best permanent life insurance option is a Guaranteed Universal Life Option.

- You can get savings by paying for the policy annually for a term or paying a one-time payment for permanent plans.

- The underwriting process takes about 3 to 5 weeks on average.

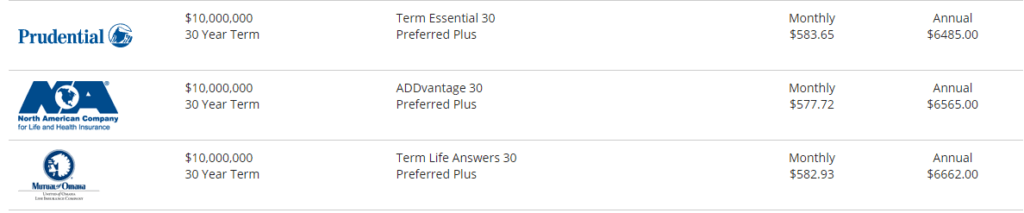

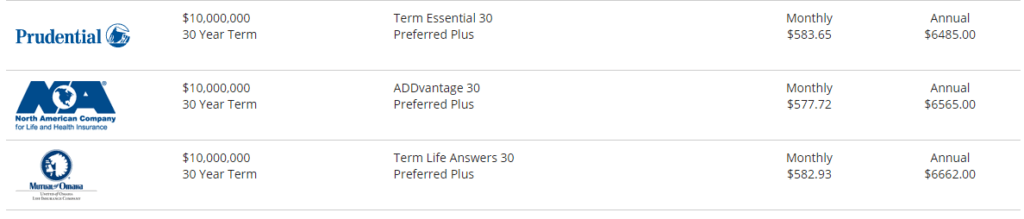

10 Million Dollar Life Insurance Sample quotes

Getting quotes for 10 million-dollar policy will vary based on the risk profile that the company will assign you and also on the type of coverage that you’re looking for. They are two types of life insurance policies people tend to buy, one is a term life insurance policy which is the most affordable option that provides pure protection coverage for a certain period of time ranging from 10 years all the way to 30 years. This coverage is ideal if you have a temporary need that you like to cover such as protecting your children while they’re young, paying off the mortgage during its term, or simply getting coverage while you’re building your retirement portfolio. After that, the need for life Insurance tends to be for estate planning or wealth transfer.

This is where a permanent type of life insurance company comes into play. There are two types of permanent life insurance whole life or universal life. The difference between the two is primarily how the cash value of the policy gets invested. In the case of a whole life policy, the cash value is usually invested into bonds so you get low-risk but also lower returns. A whole life policy, however, does give you a lot of guarantees and security but lacks flexibility. This is where a universal life policy tends to be much better because you have flexibility when it comes to your premium payments and also more options as to how your cash value generates interest. Although there are different types of Universal Life policies here at InsureChance, we recommend a no-lapse universal life. The reason for this is quite simple it’s because a no-lapse universal life also known as guaranteed universal life offers the most affordable permanent life insurance protection with a guarantee that your policy won’t lapse if you pay your premiums regardless of how the market is performing.

So now that we know that the best policies are going to be term life insurance and guaranteed universal life let’s look at sample quotes to give you a rough idea:

10 Million Dollar Term Life 30 Year Age 30 (the older you are the higher the rate will be)

Male

Female

What does it Take to Get Approved for $10 million dollar policy?

Application Process

The life insurance application process for 10 million-dollar life insurance policy is no different than an application for a $250,000 life insurance policy. When it comes to large face amount cases the first step is to find a plan based on your overall health, lifestyle, hobbies, family history and background information. Once we figure out what’s the plan and the carrier that we should go with, the application itself takes about 15 minutes to complete and then get sent over to you for an electronic signature.

Medical Exam

The Next Step would be to set up a medical examination. the medical examination, if you are under the age of 40, is the same for any other coverage amount however if you are older the company May request an additional requirement with your medical exam.

So let’s break down exactly what the company might need from the medical examination:

Based on Age for $10 million dollar policy:

*Will use Prudential for illustration purposes(hint: they are great to work with for larger cases)

Ages 18 to 40

Exam- blood, urine, blood pressure check and height and weight

MVR- Motor Vehicle Report to see all your driving history

Ages 41 to 75

Exam- blood, urine, blood pressure check and height and weight

ECG-Electrocardiogram that the examiner will perform at the time of the exam

Age Over 75

Exam- blood, urine, blood pressure check and height and weight

MVR- Motor Vehicle Report to see all your driving history

ECG-Electrocardiogram that the examiner will perform at the time of the exam

APS- Attending Physician Statement (doctors records)

Past Experiences with Clients

From past life insurance cases that were over 5 million dollars in coverage. We have noticed that actually in some cases it is a lot simpler to complete than smaller applications. We even had large life insurance cases with busy Executives or Entrepreneurs that we’re done 90% over an email. My reasoning for this is simply because most high achiever individuals tend to be in great shape and do research ahead of time, so they know exactly what they want and stay on top of the process until they are approved!

The one thing that we did notice is where High net-worth individuals that get large face amount policies they tend to have a lot of different Hobbies whether it’s flying a private plane, scuba diving, skydiving bungee jumping or any other James Bond type of activities. this can increase your rates quite dramatically and it is important to know that each company will look at you completely different. That’s why we always ask all these questions or front so we can locate the company that will give you the best rate with that in mind.

Approval Timeline

The life insurance underwriting process for a case with not too many complications will typically take about 3 to 5 weeks. In the instance that you have pre-existing medical conditions or you are a daredevil with some high-risk hobbies it may take 5 to 8 weeks. Sometimes it can even be longer if the company is requesting medical records from your primary care physician or specialist and the doctor’s office just seems to drag the whole process. Of course, this can be avoided by a simple phone call to your physician telling them to giddyup and send the records over. From the time you speak with us to the time you have your policy in hand expect about 2 or 3 months. Some agents might tell you that you could get approved sooner but it’s highly unlikely and not realistic and take it from us because we have work with thousands upon thousands of clients.

Best companies for 10 million dollars

When it comes to a life insurance policy size of 10 million dollars not many companies will offer you coverage and in some cases, you have to stack the policies together unless you work with a company that can do it in one shot. so here I’ll give you a list of our top five life insurance companies that are perfect to work with a policy of this size:

- Prudential

- Banner Life

- Principal

- Mutual of Omaha

- North American

*If you go away any one of these companies you’re selecting a carrier that has an A+ rating from A.M. Best, aggressive underwriting, amazing customer service and ability to issue a policy of this size.

Payment option for maximum savings.

When it comes to saving money on your life insurance you have to get creative or simply work for professionals who know how to get it done. the reason is life insurance rates are actually fixed by the law so you get the same rate anywhere you go, remember each company will look at your underwriting differently so although one company might give you a standard rating because of your build another one would give you a preferred rating because they all have different guidelines.

Another way to save is by selecting a certain premium payment. In the case of a term life insurance policy, you get about two or three percent discount by paying the policy annually versus monthly. Now if you’re buying a permanent type of life insurance policy you can even take it up a notch and pay a one-time payment or 10-time payment to buy your policy outright. If you make such a payment you obviously get huge savings and start the compounding of your money in the cash value account immediately versus after typical 5 years.

Why Us!

As an educated modern consumer you have hundreds of options of where you can purchase a life insurance policy and we understand that. This is why here at InsureChance, we have differentiated ourselves through our expertise, relationships with the carriers, technology, and outstanding lifetime service. We also work with over 60 different top-rated life insurance carriers and put the power of shopping for quotes in your hands so you can find the best plan to protect your family. Once we complete the application we don’t stop there, we take it a step further and draft a cover letter to help you get a better rate. We will also do a quick quote with various carriers to get a pre-approval so we know exactly which company will give you the most competitive plans before even applying. If you like to start shopping around feel free to use one of our quoters to compare plans from all the top carriers otherwise give one of our experienced and knowledgeable agents a call to give you a VIP experience. Welcome to InsureChance!