As an independent agency we work with many popular life insurance companies out there. Because we work with different life insurance companies, we can offer an objective look at each company and review it for our consumer with an honest perspective. We are able to look at each company through a lens of experience and see how they have benefited our customers over the years and how they stack up with the competition. One of the most popular of those companies is Voya Life insurance. So is Voya a good company? Do they have good products? How do they compare to what’s on the market? Let’s answer these questions and more in this article.

In summary, Voya Life Insurance has an outstanding product offering that competes with the best of the best on the market. Their term life insurance policy comes with a conversion privilege at no extra cost and comes with all the typical add on’s you can hope for a term policy to have. Their products, financial strength, and application process is similar to that of competitors. To compare quotes with Voya, use this page. Otherwise, let’s dive into detail.

Voya Life Insurance Products

Voya Life Insurance has an array of products that boil down to two categories. They have their term life insurance policy that goes by the name of Voya Term Smart and their Universal Life Insurance permanent products that accumulate cash value. Let’s look into them a little more.

Voya TermSmart

Voya TermSmart is a term life insurance product offered by Voya. It is a temporary coverage that comes in term lengths of 10, 15, and 20 years of coverage. Coverage amount options are typical for a term life insurance policy and range between $100,000 to upwards of millions of dollars. This is a level term product which means that throughout the length of the policy your premium won’t go up or down and is guaranteed to stay locked in. Before the expiration of the term you will be able to convert the coverage to one of their permanent products. According to their website you will have to do so during the earlier half of your term policy or before age 70. You will be able to convert without having to take a health exam or prove good health, as long as you’re not looking to increase the coverage amount.

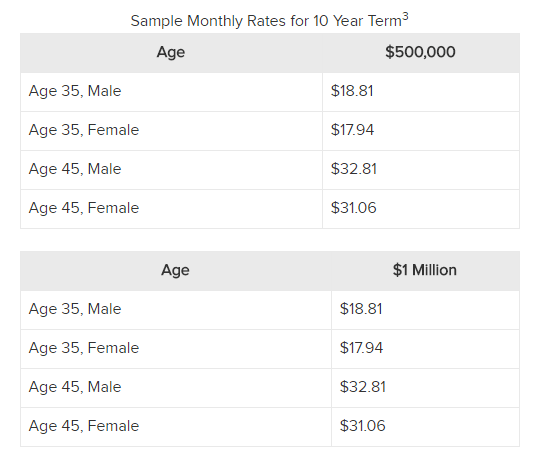

Here is a sample of rates from their website:

Return of Premium

They also have a return of premium option for their term life insurance policy. Return of premium does exactly what the name says, you get all of your premiums back at the end of the term period. You can choose between 20 or 30-year term life insurance options. At the end of the 20 or 30 years, you will receive all your money back. Personally I don’t always like to recommend this option because it is twice as much in cost and that money you get back will be worth a lot less in 30 years.

Term Policy Add On’s

Most life insurance carriers offer custom add on’s to life insurance policy known as riders. Here are a few of the most common riders.

Accidental Death – this is an add on that allows your beneficiaries to receive extra money if your death is a result of an accident. This means they will receive the original death benefit amount plus the accidental death benefit amount. If your death is a result of a natural cause, then you only get the original coverage amount.

Accelerated Death Benefit – this is an option that usually comes free of cost. It allows you to receive a portion of your death benefit if you are diagnosed with a terminal illness. You can use it as you please and if you happen to beat the illness you don’t have to pay it back. It will simply be subtracted from your total death benefit amount.

Waiver of Premium – this is a rider that allows you to “waive” your premium while keeping your coverage in force in the event of a disability.

Child Rider – the child rider allows you to get up to $10,000 worth of life insurance coverage for each of your kids.

Voya Universal Life

Voya has a universal life insurance product as well as indexed and variable universal life insurance products. These are life insurance policies built for permanent life insurance protection and are designed to provide lifetime coverage. With these policies you get a tax deferred investment built into the policy. Your returns will depend on the type of universal life insurance policy you pick. Once your policy builds up some cash value you can borrow against it as a tax-free loan. Some of the options also offer flexible premium payments to your discrepancy.

Vs The Competition

Overall Voya is one of the most competitive companies out in the life insurance marketplace. They often have very competitive rates and have a great product offering that is typical for a company if this stature. It stands among the best of the best with the likes of MetLife, AIG, Prudential, Banner and more. Let’s look at what they do good and what are some of their pitfalls.

What They’re Good At

Voya does have a few underwriting specialties that are superior to some of its competitors. First, they don’t have questions regarding family history on the application. Often people who are in good health get rated down due to history of cancer in the family. With Voya you can qualify for the best rates as long as you are in good health. If you have slightly higher than normal blood pressure or cholesterol reading you may also do better off applying with Voya as they are more lenient on the numbers. We have found in the past that it is a possibility to also get nonsmoker rates if you smoke cigars occasionally. Verify that this is the best option with your agent as there are other competitors that may be better for cigar smokers.

The Downfalls

Normally this wouldn’t be a downfall but with the recent wave of no medical exam life insurance products, it’s a shame Voya doesn’t have one. Many life insurance companies offer a no exam life insurance product as part of their portfolio of offers. This isn’t one of those companies. With their reach, financial strength and overall popularity, Voya should be able to offer a wider variety of products to convenience seeking customers.

Application Process

Their applications process is standard among the industry. It is a few step process that and take 6 to 8 weeks to receive approval for a life insurance policy.

1. Prequalifcation – if you’re working with a good agent then you will have to go through this process. Your agent will ask you some health and history questions and few details about your medical history. This is the point in the application where a knowledgeable agent determines whether Voya is the best company for you to apply with and if they’re products can satisfy your need for life insurance.

2. Application – the life insurance application consists of some personal information as well as a verification of your pre-qualifying questions. At this point you will also set up your beneficiaries and schedule your medical exam.

3. Medical exam – the life insurance medical exam is done whenever and wherever you choose. It takes about 20 to 30 minutes and runs like a checkup at the doctor’s office. The nurse will come out to see you and do a physical along with a blood and urine sample. Ask you a few questions and be on her way.

4. Underwriting – this is the part where the life insurance company reviews everything about you. They will look into your medial history, run a background check, review your application and your medical exam results. Once they do all of that they will determine your rate and your qualification for coverage.

Past this point you should expect your life insurance policy to be approved and be sent to you in the mail for signature. Your agent, if any good, will let you know if you are approved beforehand. As you can see, the application is pretty similar across all carriers.

More About Voya

In 2014 ING U.S. became Voya Financial. So if you’re familiar with a company once known as ING, this is them. They fully completed their re-branding in 2014. It is also the remnant of what was once known as ReliaStar. Currently Voya has 13 million customers and about $486 billion in Assets Under Management. Voya was once in the Fortune 500 list and World’s Most Ethical Companies list by the Ethisphere Institute. Currently they are rated “A” by A.M. Best, Fitch, And Standard &Poor’s, with an A2 rating by Moody’s. These are all financial institutions that grade the financial strength of life insurance companies.

Verdict

Overall Voya Life Insurance is definitely a company we recommend to our clients over and over again when it makes sense to their life insurance needs. There aren’t really any real pitfalls with Voya but you should always shop around with all the companies out there to make sure you’re getting the best rate. Most of the A rated life insurance companies have the same product offering, with the only difference being the rate for your specific situation. So while we give Voya a stamp of approval, we still recommend you work with an agent to do your due diligence.

Start Here

The good news is you’ve reached your destination. We are an independent online life insurance agency that does all the life insurance shopping on your behalf, at no extra cost to you! If you have any questions about Voya Life Insurance or want to run a quote and see how it compares to its competitors, give us a call at 888-492-1967 or hit the chat button below. Welcome to InsureChance!