So you have heard a lot of positive things about whole life insurance such as its ability to accumulate cash value, provide dividends and of course what it is really known for lifetime protection. You either already got some quotes for a whole life insurance or you’re simply shopping around but you have now realized that it’s actually quite expensive so now you’re looking for the most affordable option out there. Well, there is a way of getting the most affordable whole life insurance policy and we will discuss it in this article, there is also an option that can be almost half the cost of a whole life policy. So let’s see what options you have available to secure a cheap whole life insurance policy.

What is a Whole Life Policy?

A whole life policy is a form of permanent life insurance coverage and it is actually one of the first ones to come out in the market. Individuals that want a whole life policy are usually interested in having lifetime protection, transfer of wealth, estate planning, and in some cases a tax-deferred cash value accumulation. Whole Life policies are also popular because of their guarantees which are usually available through the premiums and a guaranteed interest rate return on your cash value account. Just in case you are confused, a cash value account is where a portion of your premiums will get deposited to and collect interest based on the type of investment the policy has. In the case of a whole life policy, the investment that they use is usually government bonds and if you go with a mutual life Insurance company then you may also collect dividends based on the company’s yearly performance.

Getting The Most Affordable Whole Life Insurance Policy

Well, you are here to find out how to get the best value for your dollar so let’s not waste any more time and get straight to it. Getting a whole life insurance policy for cheap comes down to a few fundamental steps that you can follow and it’s actually quite simple. The first step to doing that is to work with an agent or an agency that is independent, meaning they work with multiple companies and don’t have loyalty to just want. This is very important because an agency or an agent that has an independent status can shop around with lots of carriers to see which ones offered the best deal, without you having to waste your valuable time. For instance, a bit of a shameless plug but here at InsureChance, we work with over 60 top a rated life insurance companies and allow our clients to compare rates instantly on our website with our state-of-the-art comparison tool.

Once you are working with an independent agent or agency the next thing you need to do is find a company that will give you the best rate based on your overall health and lifestyle. what many individuals don’t know is that no one company will look at you the same. For example, if one company thinks you’re overweight another company might say that you’re totally ideal weight or if one company thinks that your diabetes is uninsurable another one might think that you qualify. So be sure to be upfront about all of your health and lifestyle information so your agent can do their job and find you an appropriate company to work with.

The two steps we have discussed so far will get you a long way with getting a cheap whole life insurance policy but there’s also another way if you have the dough! This way is saving through pre-paying for your policy. See most people pay for their whole life insurance policy with a monthly payment but they don’t realize that if you pay annually the company gives you a small discount which can accumulate to a large sum if you calculate how long the policy might be around. However, there’s even another option by paying the policy with a one-time payment or 5 to 20 annual payments which will save you, even more, actually quite a sum of money. Of course, it is important to note that the less amount of payments you make, the more you actually save. If you’re an individual who is worried about the investment side of the whole life policy, this also helps you start the compounding process much faster than somebody who would be paying monthly payments.

BEWARE: As the saying goes: “Cheap things are not good and good things are not cheap.” This somehow does apply to whole life insurance and that’s why if you find a cheap policy be sure to compare the benefits and the policy bullet points to other policies of the same sort just to be on the safe side and to ensure that you’re not getting the short end of the stick. You might also want to know that whole life insurance returns are actually very small and you should only expect between one to two and a half percent returns from your whole life policy which is not a lot. However, you can maximize this by working with a mutual company a mutual life insurance company is when the policyholders have part ownership opposed to a regular company where stockholders are shareholders.

Whole Life Insurance Alternative (GUL)

If you are someone who is looking for a whole life insurance policy because you simply don’t want a term policy because it expires and you were just wanting a type of life insurance that covers you for a lifetime then I will let you in on an industry secret.There is actually a lifetime type of coverage that provides fixed payments and a fixed coverage amount for a fraction of the cost of a whole life policy. This policy is called guaranteed universal life or also known as no lapse universal life, this is actually the most popular permanent life insurance policy at our agency that individuals purchase when they’re looking for a lifetime protection.

This policy also has cash value accumulation but is not going to get you on the Forbes list by any means. What it does have is simplicity and lifelong protection with a huge focus on affordability. In fact, many of clients who have whole life policies tend to switch over to this option once we show them the difference in cost. You can learn more about it in our article here and feel free to check out some quotes for it too.

Whole Life vs Guaranteed Universal Life Quotes

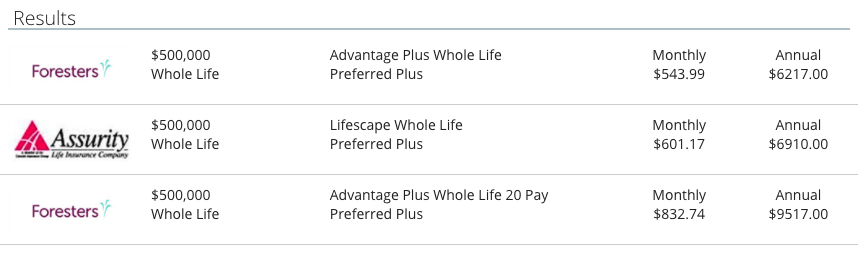

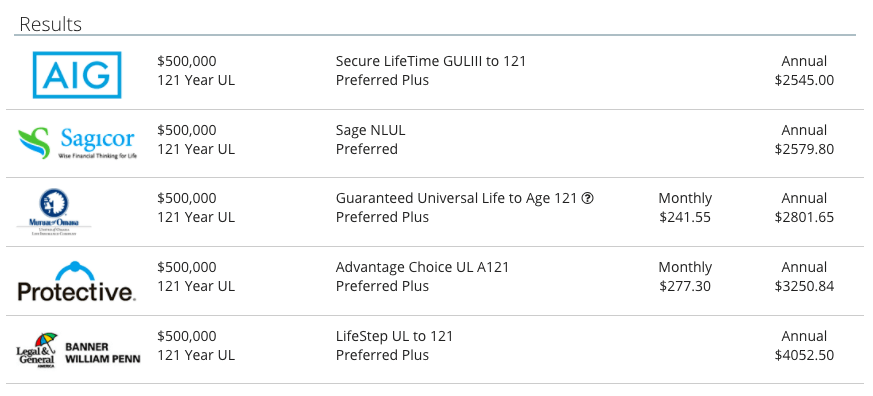

Here is a quick rate comparison for a healthy 40-year old female looking to get $500,000 permanent type of life insurance:

Whole Life

Guaranteed Universal Life

As you can see there is a huge difference in the cost and if you’re wondering if there is a selfish reason for us to promote this product you’ll be relieved to find out that we would actually make way more money selling our clients a whole life policy but here at InsureChance our clients are family and you don’t cheat your family.

Final Expense is Whole Life Too!

There are whole life plans that are known as a final expense or burial policies which are designed to cover you up to $50,000 of life insurance with few questions and no medical exam. These plans are ideal for people in not such great health since they can have tiers of when the coverage will start. These plans also tend to be more expensive since you have to go through fewer qualifications to secure a policy. Most seniors are offered a final expense plans but often times if you’re over age 50 and in good health, you’re better off going with an actual whole or universal life policy. Final expense plans are available with level benefits(Good Health-effective immediate), Graded (Fair Health- effective in increasing increments within 36 mos.), and guaranteed issue(Poor Health-effective after 24 mos). If you were interested in getting quotes for a final expense whole life than simply click here and pick out your health status to see quotes from top brands.

Work With Us!

Our sole purpose is to empower modern consumers through our informative articles and state of the art comparison tool which allow you to see most up to date quotes from over 60 top rated life insurance companies. In addition to that, we can help you secure a policy if you were previously turned down due to bad health or dangerous occupation. All of our clients receive lifetime support and we go the extra mile by drafting a cover letter and doing quick quotes which are prequalifications before we apply. If you’re ready to shop for life insurance simply check out some permanent life insurance quotes or call one of our friendly agents at 888.492.1967. Welcome to InsureChance!