As an independent agency, we get to work with all of the life insurance companies out there. So when we do reviews like this we are able to not show any bias towards any company. We hear about AAA life insurance a lot from our consumers so we decided to dive in and let everyone know how we see it. So let’s review their term life insurance products and see how it stacks up vs its competitors in the life insurance industry.

In summary:

- AAA has two great term products in their Traditional Term Life and Express Issue Term offers.

- Their traditional term product is competitive with all the good term life insurance companies on the market.

- Their express issue, while a good product with an easy application process, comes second to some no exam competitors.

- Not 100% customer satisfaction for customer service post approval.

- AAA is an A- rated life insurance company which means it financially stable.

That’s our review in a nutshell, in reference to the picture above I’d have to say I accept. Now let’s go over AAA life insurance in detail.

AAA Life Insurance Company 2017 Review

You probably have seen an AAA Life Insurance commercial, it’s one of those sad commercials that make you sit there and actually want to buy life insurance! AAA Life Insurance Company has been around since 1969 and they offer life insurance and annuity products. They are headquartered in Livonia, Michigan and the company is owned by several of the largest entities in the AAA organization. AAA has over 1,200,000 active policies and they also take great pride in their community involvement.

AAA Term Life Products

AAA also known as “Triple A” has two popular term life insurance products. One is a traditional term life insurance policy and the other an express term life option. This means and expedited application and underwriting process. Let’s go over them in detail.

AAA Traditional Term

In case you didn’t know term life insurance is a form of temporary life insurance that provides you with coverage for a short and specified period of time. “Term” refers to the period of time you would like to stay covered for. Term life doesn’t offer the opportunity to gain and accumulate cash value. The traditional term life insurance product with AAA has coverage amounts between $100,000 and over $5,000,000. This is normally an adequate range for anyone looking to get a term life policy in place. The coverage lengths range from 10 to 30 years for those between 18 and 75 years of age.

Their term coverage is renewable and convertible as should be the case with any term life insurance policy. You can renew the coverage every year once the term expires regardless of health. This can get quite expensive because your rates will increase every year according to your new age after the term expires. During the term, however, your rates will be locked in for the term length. The coverage is also convertible, which means you can convert it to a permanent policy before age 65 or before you used up 80% of the term length, whichever comes first. Most life insurance companies allow you to do this without proof of insurability. Meaning even if you got really ill during the term, you can still convert at the same health class rating you qualified for at the inception of the policy.

AAA Express Term

Their express term life insurance product is a no medical exam product. This means that you can skip the typical underwriting process that comes with a traditional policy. No nurses coming out to your homes, no phone interviews, just a few health questions on the application. This product caps the coverage at $250,000 for a 10 to 30-year term length. The premiums are guaranteed to stay level for the entire length of the policy. There is an option to renew annually, however, doesn’t seem to have a convertible option. The really great part about this product is that you can apply online.

AAA Whole Life Insurance

Whole life insurance is a form of permanent life insurance that provides you with coverage for you guessed it, your WHOLE life! Since whole life insurance is a form of permanent life insurance it provides you with the opportunity to gain and accumulate cash value. AAA offers a simple whole life insurance product that guarantees this accumulation of cash value over time. This product also doesn’t require you to undergo a medical exam just to answer a few health-related questions in return. Coverage for this product ranges between $5,000-$25,000 and anyone between 15 days old and 80 years old can apply for this product. You can get as much as 50% of your benefit if you are diagnosed with a terminal illness with less than a year to live. Your premiums will stay the same until age 100 and at that point, your premium payments are no longer required.

AAA offers another whole life insurance product that is called a guaranteed issue graded benefit. As a guaranteed issue product this means you are guaranteed coverage no matter what situation you are in. Your coverage would be lifelong and doesn’t expire. There is no medical exam necessary nor do you have to answer any medical question. Premiums stay the same until age 100 at which time premium payments are no longer required and this policy still builds cash value over time. With this product you can get up to $25,000 in benefits and a graded benefit is provided in the first two years.

AAA Universal Life Insurance

Universal life insurance is another form of permanent life insurance and offers you coverage for your whole life. The difference between universal and whole life insurance is that a universal policy is more flexible. Universal life insurance allows you to be flexible with your payments and death benefit. You can choose when you want to pay, how often, how much, and if you want to make changes to your death benefit you can do so. AAA offers a LifeTime Universal life insurance product. This product offers you coverage amounts between $25,000-$5,000,000+. You are eligible for this product if you are between 15 days and 85 years old. There is, however, a medical exam that you have to undergo and there are also some health questions that you will have to answer for coverage. Your premiums will stay the same until age 100 at which time your premium payments are no longer required. You can also get as much as 50% of your benefit if you are diagnosed with a terminal illness with less than a year to live. If you didn’t already know since this policy is still a permanent form of life insurance you are able to grow and accumulate your cash value.

AAA has a second universal life insurance product called the Accumulator Universal product. This product still offers the same flexibility as a traditional universal life insurance policy and coverage is designed to last a lifetime. Your coverage may range between $25,000-$5,000,000+. You are eligible at any age between 15 days and 80 years old. You will have to undergo a medical exam and answer a couple of health questions for coverage. It will take between 2-6 weeks for coverage if you qualify. You can adjust your premiums as your needs change. By paying the “no-lapse” amount, your coverage is guaranteed for 10 years. You can also get as much as 50% of your benefit if you are diagnosed with a terminal illness with less than a year to live.

Vs Other No Exam Plans

While this is a very solid no exam product, there are no exam companies out there that edge it out slightly. When it comes to speed this product holds in with the best of the best. Where it falls short is its $250,000 coverage cap and what seems to be a lack of a convertible feature. Companies like Sagicor offer up to $400,000 with a convertible option for their term product. The only thing left to see is how it compares to cost.

Add On’s – Riders

The AAA term plan comes with a few riders that are typical for a good term life insurance product. These include a terminal illness rider at no extra cost and few other riders you’ll have to come out of pocket for.

Terminal Illness – This is an add-on that will allow you to access up to 50% of your death benefit if you are diagnosed as having less than 12 months to live. This is subtracted from your total death benefit amount.

Return of Premium – This is a rider that allows you to receive all of the premiums you paid into your policy back at the end of the term period. This is of course given the fact that you didn’t die in the process and use the coverage.

Children’s Term Rider – This a rider that allows you to get coverage for your child as an add on to the policy. You can get up to $20,000 of life insurance coverage per child.

Disability Waiver of Premium Rider – The explanation is mostly in the name. This rider will let you waive all your premiums for the period you are deemed disabled.

Cost

Overall AAA seems to be providing a solid offer with their term life insurance products, but how much does it cost. Let’s run a few quotes for a healthy 35-year-old male and see what we get. We will run $500,000 for a traditional term and $250,000 for the express issue term.

Traditional Term Rates

Here are the rates for the traditional term AAA product vs the traditional term products for other companies.

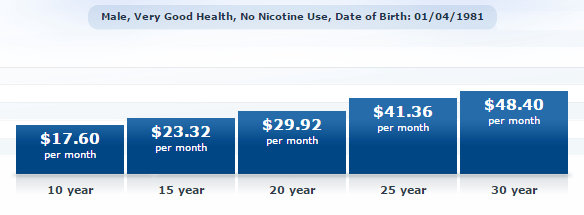

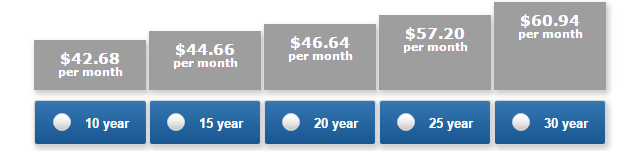

Here are the AAA rates from 10 to 30 years:

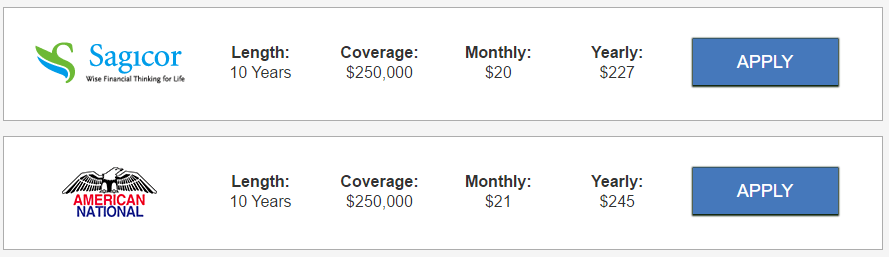

The competitors with the lowest rate. Keep in mind this is the same type of product for the same person.

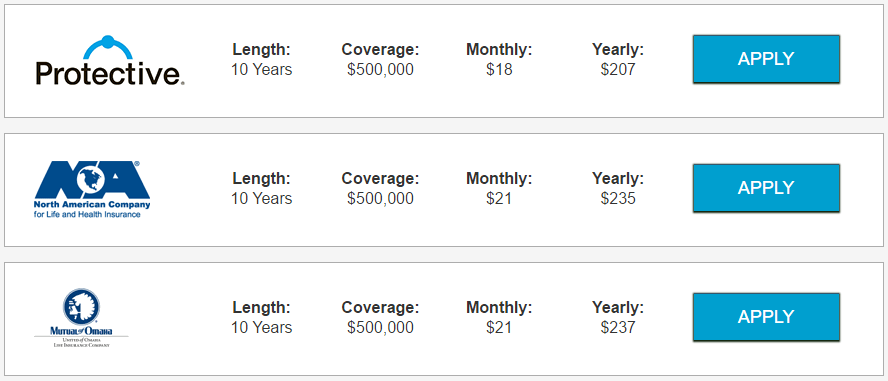

10 Years

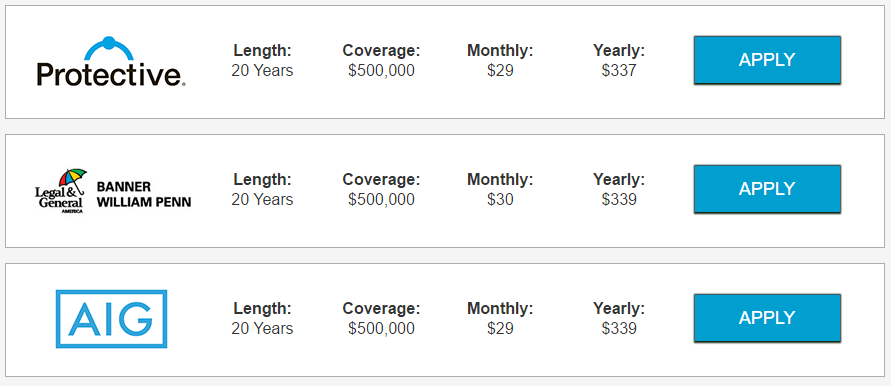

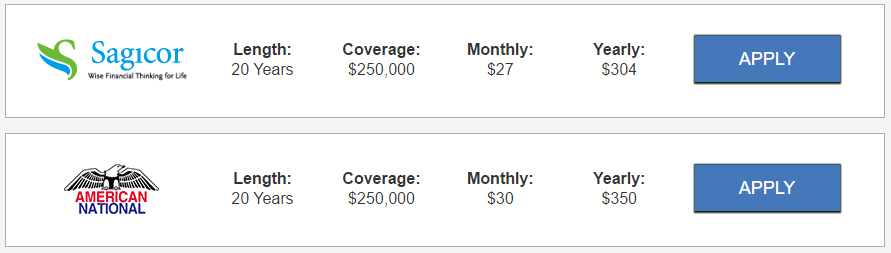

20 Years

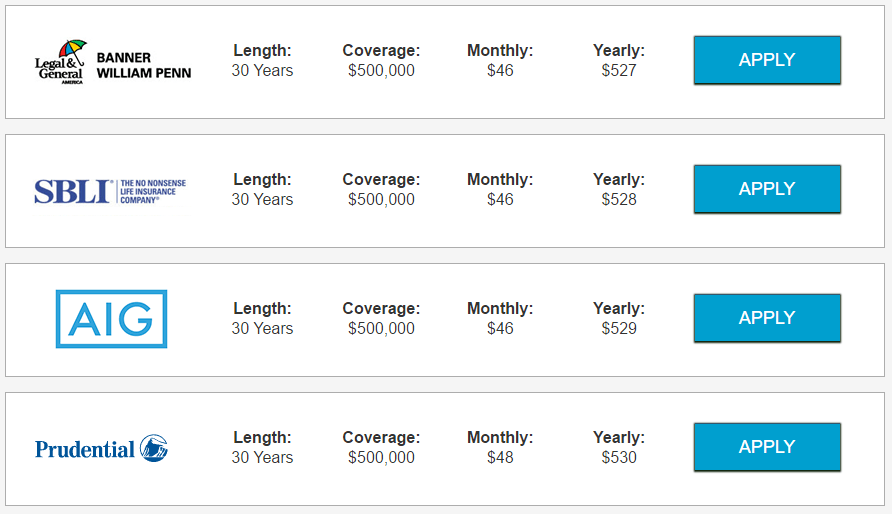

30 Years

Express Issue

AAA rates

No Medical Exam Competitors:

10 Years

20 Years

These competitors have the ability to offer higher coverage caps and in some cases, convertible coverage and they cost almost half as much.

How It Stacks Up

Overall we think that AAA offers a good term life insurance option. But we like to break it down into criteria of price, product, and process.

Price – for their traditional term life insurance product AAA is very competitive for the younger age bracket. For the express term, a few of its competitors were able to out do it. The best thing is to always run quotes with all the companies to see what the rates are for you specifically because they always vary case by case. Overall though, we can’t say their costs are outrageous, they are very competitive here unless we’re talking express issue.

Product – their product offering is up to par with its competitors. The only thing that would be left to do is compare the rates to see if it makes sense for you. Also, keep in mind all companies view certain risks differently, so if you’re a high risk, always shop with a high-risk agent. Because if one company declined you, doesn’t mean they all will. Some companies might rate you up, others might have an amazing offer, so always shop.

Process – their process is similar to most life insurance companies. Both for the traditional and express products. Overall the AAA offer seems to be a good one.

What Everyone Else is Saying

A quick search of AAA will bring up some customer reviews from Consumer Affairs and Complaints Board. On consumer affairs, most customers are satisfied with the process to acquire the coverage, with the few complaints coming with post coverage service. Things like reimbursing wrong charges seem to take a while to satisfy. Otherwise really good ratings. Complaints Board offered a less optimistic review, which can be expected given the name of the site. You can read some of the customer complaints here but most revolve around a difficult claims process.

Shop Around

Despite AAA being an all-around good life insurance company. We still recommend you do your due diligence and shop around to ensure that you get the best rate on the market. The good news is you’ve reached your destination. We represent over 60 A-rated life insurance companies on the market and know exactly which company will offer you the best rate based on your specific situation. If you have any questions about AAA or want to do some shopping, give us a call at 888-492-1967 or hit the chat button below. Welcome to InsureChance!