It’s time to finally come around and buy a life insurance coverage for your family, but you’re wondering if American National is right for you. This is probably one of the most important things you can ask yourself since a company that goes out of business will not be able to pay any claims. The good news is that we actually work with American National plus other 50+ companies so we know a few things about what makes a company a good fit. In this article, we will cover what you need to know about the company and their variety of products. Here is a quick summary:

It’s time to finally come around and buy a life insurance coverage for your family, but you’re wondering if American National is right for you. This is probably one of the most important things you can ask yourself since a company that goes out of business will not be able to pay any claims. The good news is that we actually work with American National plus other 50+ companies so we know a few things about what makes a company a good fit. In this article, we will cover what you need to know about the company and their variety of products. Here is a quick summary:

- It all started when a well-respected member of the life insurance industry, William L.Moody Jr. founded American National Insurance Company, or ANICO, in 1905.

- This company has been around for over 100 years and still follow the same core ideal! American National offers a broad variety of life insurance, accident and health insurance, pension plan products and services, credit insurance, retirement annuities, and property or casualty insurance for personal lines.

- Aside from their own history, they also have a long history of giving back to the community and support many charities.

- According to A.M Best, American National Life is rated an “A” for their financial strength. They are also rated an “A” by Standard & Poor’s Rating.

- A life insurance company that has the highest financial strength rating awarded by all four major credit rating agencies would clearly be a wise placed to start looking into especially if you’re looking for a company with security.

- American National Life offers a broad variety of products in their product lines such as; Whole Life, Term Life, Universal Life, Indexed Universal Life, Variable Universal Life, and Credit Life.

- Whole life insurance is a contract designated to provide protection over the insured’s entire lifetime.

- Term life insurance provide coverage for a certain duration of time only.

- They have one of the best no medical exam term life plans where you can get up to $250,000 of life insurance coverage without a physical.

- Universal life insurance is a type of permanent insurance that offers cash value build up and low-cost protection.

- To choose the number of years (term) you simply match the period of time you will need the coverage to the available rate guarantee period.

- Shopping for life insurance is easy on our website. We have a simple quote calculator that you can utilize in order to get an idea of what you are looking for and how much.

About American National Life

It all started when a well-respected member of the life insurance industry, William L.Moody Jr. founded American National Insurance Company, or ANICO, in 1905. Their core ideal never faded; “strong management, prudent investment, and financial strength.” This company has been around for over 100 years and still follow the same core ideal! American National offers a broad variety of life insurance, accident and health insurance, pension plan products and services, credit insurance, retirement annuities, and property or casualty insurance for personal lines. ANICO is headquartered in Galveston, Texas and has more than 3,000 employees. They also provide service to more than 5 million policyholders. According to its SEC report, American National Insurance Company, as of 2014 had over $23 million in assets. American National conduct their business in all 50 states and even in Puerto Rico.

ANICO Giving Back

Aside from their own history, they also have a long history of giving back to the community and support many charities. Their teams annually participate in the American Cancer Society’s Relay for Life event and help raise money for cancer research and cancer patients. They participate in D’Feet Breast Cancer Walk, Flags for Veterans, and Fall Street Machine Nationals. ANICO also participates in United Way of Galveston County where they contribute $200,000 annually which supports more than 90 local charities in the Galveston/Houston area. Raising over $44,000 for United Way of the Ozarks, ANICO has been awarded the “Silver & Gold Award” which put the company in the “Major Contributor” on its campaign category. Every year the company organizes a carnation sale for Valentine’s Day with giving its proceeds to the Resource and Crisis Center of Galveston from the Show You Care Foundation.

Company Rating and Review

The company has a strong “A” rating from one of the leading rating agencies A.M. Best and same rating from S&P as well. Having a strong rating is a good indicator that your family will get a check if anything was to happen to you.

For instance, Martha and Moe bought a life insurance policy from a not very known company called Company W and they read on their website that it’s an easy application even though they scored a pretty bad rating for the rating companies. That didn’t matter to Martha and Moe because they’re busy people and have three children driving them nuts, they don’t need to spend any more time researching because a quick application was a good sale for them. Company W has only been established for 7 years and is very weak when it comes to their financial standing and the ratings. 3 years later, a whole lot of premiums later, disaster occurs, and the market turns to the worst.

However, the stable insurance companies seem to be handling it well, not Company W, they already have a history of weak financial performance and decide to pull out before they go bankrupt. There go all the premiums that Martha and Moe paid, gone with the wind! They have three children and now more worry than they had, to begin with. If Martha and Moe had read into the company’s rating they would have realized that it’s a rip-off and they would be happy with another reliable company with the future ahead of them instead of trust issues and disappointment. Don’t be like Martha and Moe, if you are too busy to shop around get yourself an independent life insurance broker to help you find the best company for you and your family to depend on because money doesn’t come from thin air, so don’t let your money fly with the wind and invest in some outside help!

Products

American National Life offers a broad variety of products in their product lines such as; Whole Life, Term Life, Universal Life, Indexed Universal Life, Variable Universal Life, and Credit Life.

Whole Life

What is whole life insurance? Whole life insurance is a contract designated to provide protection over the insured’s entire lifetime.

Legacy Whole Life Insurance

- If you’re between the ages of 50 and 80 you’re approved.

- No medical exam.

- No health questions.

- Rates are fixed so they don’t move up or down.

- Benefits never go down.

- The possibility of building cash value.

- 30-day money back guarantees.

- Up to $25,000 of coverage.

ValueGuard Whole Life Insurance

- No medical exam.

- Quick approval, less than 15 minutes.

- No health questions.

- Face amounts up to $150,000.

ANICO Signature Whole Life Insurance

- Guaranteed cash value.

- Accessible cash value for emergencies.

- Guaranteed death benefit.

Term Life

What is term life insurance? Term life insurance is a pure protection plan with no cash value that provides protection for a certain period of time like 10 to 30 years.

ANICO Signature Term Life

- 10, 15, 20, and 30-year terms.

- No medical exams.

- No health questions.

Freedom Term Life

- 10, 15, 20, and 30-year terms.

- Convertible to permanent insurance later.

- Fixed premium payments.

- Affordable coverage.

Universal Life Insurance

What is universal life insurance? Universal life insurance is a permanent plan that is similar to whole life but has a lot more flexibility.

- Flexible premiums.

- Flexible benefits allow you to increase or decrease the benefits your beneficiary will be receiving.

- Accumulative cash value.

- Accessible cash value for loans or unexpected financial needs.

Sample Quotes

Sample quote for 50 year old male with preferred plus health; results vary depending on health.

| Face Amount | 10 Year Term | 15 Year Term | 20 Year Term | 25 Year Term |

|---|---|---|---|---|

| $250,000 | $31 | $35 | $44 | N/A |

Sample quote for 60 year old female with preferred plus health; results vary depending on health.

| Face Amount | 10 Year Term | 15 Year Term | 20 Year Term | 25 Year Term |

|---|---|---|---|---|

| $250,000 | $25 | $25 | $32 | N/A |

Sample quote for 45 year old male with preferred plus health; results may vary depending on health.

| Face Amount | 10 Year Term | 15 Year Term | 20 Year Term | 25 Year Term |

|---|---|---|---|---|

| $250,000 | $25 | $25 | $32 | N/A |

Sample quote for 55 year old female with preferred plus health; results may vary depending on health.

| Face Amount | 10 Year Term | 15 Year Term | 20 Year Term | 25 Year Term |

|---|---|---|---|---|

| $250,000 | $120 | $150 | $253 | N/A |

Policy Riders

Accelerated Death Benefits: In the event of your death this rider provides an additional amount in the case of an accident.

Disability Premium Waiver: This rider allows you to not have to pay for premiums for at least six months in case you become disabled.

Children’s Level Term Rider: This policy allows each child until 18 years of age to have level term life insurance.

Spouse Term Rider: This policy provides level term insurance on the insured’s spouse.

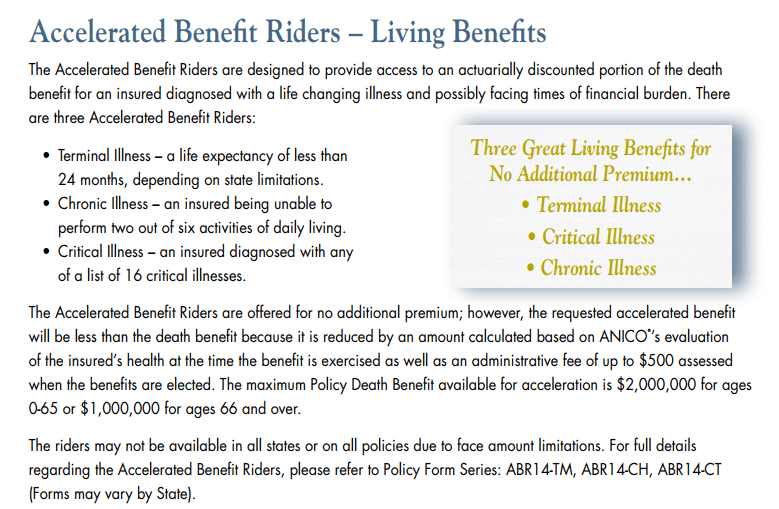

Chronic Illness Rider: In the case of the insured being diagnosed with a chronic illness or have less than 6 months to live, this rider allows the insured to have access to death benefits for the cost of living such as nursing home or medical bills.

Most Popular Product: No Exam Term

We work with a lot of different clients and American National is one of my favorite companies. Out of all the products they, there is one that is very popular which is their no medical exam term life insurance plan. You can get up to $250,000 for a variety of term lengths without having to do a medical examination. The best part it’s an electronic application so you can complete the whole process without having to leave your iPad or computer. This is also one of the few term life insurance plans that come with 3 different living benefits, that’s right you can use your life insurance not only when you die. The living benefits with this plan allow you to access the face amount of your coverage if you have a critical, chronic or terminal illness. This is a huge plus since it can be a great supplement to your health insurance. This plan is also convertible so if you wanted to turn it into a whole life plan you can do so without any new underwriting.

Here is a snippet from the plan brochure about their living benefits:

What’s the next step?

So is American National a good company? YES! But that doesn’t mean you should shop the entire marketplace to see what else is out there. Here at InsureChance, we work with over 60 top rated insurers to get you the best rate. We have a lot of companies for term life, no exam, and final expense so whatever your life insurance needs we got you covered. Feel free to use one of our comparison tools today or call us at 888.492.1967.