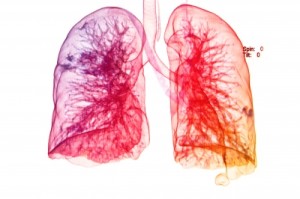

Trying to get life insurance with COPD can be difficult at times since the disease can get progressively worse. It affects millions of Americans and can be life threatening so life insurance companies will approach the application with caution. The condition itself is a combination of Emphysema and Chronic Bronchitis which in most cases are caused by smoking or inhaling chemicals that destroy your lung lining. If you have COPD and you smoke, you can not qualify for traditional coverage, same is true if you require oxygen. In that case, your only option is a guaranteed issue plan. Otherwise, it is possible to get life insurance if you apply with the right company and have your condition under control.

When applying for life insurance, companies will want to get details about your COPD. Details such as the date you were diagnosed, the severity of symptoms, degree of impaired respiratory function, smoking history, types of treatment and medications used. In addition to that, they will want to know your current build to see if the condition has caused abnormal weight loss. On top of this, they will also use any other medical conditions and lifestyle information for their final consideration. Remember every carrier will rate you differently so picking the right life insurance company is very important. Applying to the wrong company will result in a decline but when we carefully determine the right one to go to with based on condition, results can be great. That is the main reason why we work with over 60 companies, so we can have a large pool of them to choose from.

Once the company has all the details gathered about your overall health they will take about 3-6 weeks to come back with a decision. Based on the underwriter’s evaluation of your application you will be assigned a risk class which will range from preferred, standard or substandard(high risk). If you have COPD the best rate class you can get is standard or substandard depending on the severity of your condition. If you get substandard it is important to know it has 10 levels known as tables ranging from table 1 to table 10.

Severity of COPD and Expectations

Mild – If you are experiencing minimal complications and your COPD is stable with no medical treatment expect to get standard rate class. This means you will get average rates if you apply with companies that are more aggressive with their underwriting like Prudential or TransAmerica.

Moderate – You have moderate COPD if you are experiencing more severe coughing with shortness of breath. In addition, you might be also taking medications such as an inhaler. If you apply with the most competitive companies that underwrite COPD you can expect substandard table 2 to table 6 rate classes. This can make the policy a lot more expensive but you need to remember that this is will still be the best option out there.

Severe – If you have lung function over 40% and are maintaining your condition with steroidal medication expect substandard table 6 to table 8 ratings. If your lung function is under 40% you will likely be declined for coverage. If declined you can still qualify for a guaranteed issue plan. In some cases, approvals can be increased by doing some additional steps that most people don’t do.

Improve Odds of Getting Life Insurance with COPD

When it comes to getting approved with any preexisting condition an experienced agency knows that all the little extra things can go a long way. So for our clients who have the chronic obstructive pulmonary disorder, it is no different. Let’s review some of the industry tips you and your agent can follow to ensure you get the best rate:

- Get Prequalified– there is an actual way where you can have life insurance underwriters give you an offer if you have COPD before going through an application. This process is known as Quick Quote, basically, an anonymous email that gets sent to carriers for a preliminary offer which can be attached on top of your application.

- Get a Cover Letter– this is a great way to let the company underwriter know more details about you that can’t be included in the application. For example, if you have COPD but you also happen to be a person who does a lot of exercises and eats clean that will make you a better risk than most other applicants.

- Work with HighRisk Agency– if there is one thing you can do to get better odds with COPD approval than this is it. A high-risk agency will know where to apply and have all the additional bases covered. In addition to that, they will most likely work with multiple carriers so they can have more options to try before giving up.

Now if you did all of the above and still got turned down then you should either work on your health and let some time to pass or apply for a guaranteed issue policy. These plans are limited to about $25,000 and do have a two-year waiting period but they don’t ask any questions or require and exam. After the waiting period, they are actually pretty great whole life policies that will provide lifetime protection. We have had a lot of clients with severe COPD that simply stacked multiple guaranteed issue policies together.

Call US!

Now here is what you should do to get the best outcome possible. Contact one of our high-risk agents online or by calling in so they can gather the necessary information about your COPD. That way you will be given an accurate quote and also we can establish which company to apply with. Before applying we like to do a quick quote. This is where we submit an anonymous request for a possible decision to one of the companies underwriters. It can be very useful since we know the most likely outcome and have something in writing to attach to your application. We also have an in -house underwriting team that will have a pretty good grasp on what you can expect to pay and get from each carrier. Call us at 888-492-1967 and let’s get started.