It is time to buy a life insurance policy and you decided to go with a round number so you picked $500,000 or did you actually jot down and figure out how much your family needs?

It is time to buy a life insurance policy and you decided to go with a round number so you picked $500,000 or did you actually jot down and figure out how much your family needs?

Either way, life insurance is not a complicated concept, it just has a lot of different questions such as what type of life insurance do you need, how much coverage do you want, and who will be your beneficiaries.

Of course, taking into account your health and lifestyle. You found this article because you realized that you want to purchase life insurance to protect your family but aren’t quite sure how much life insurance coverage to buy or if $500,000 is enough life insurance coverage, but don’t worry because here at InsureChance we will help you decide whether or not $500,000 will be adequate to cover all your life insurance needs.

Is $500,000 enough coverage?

Is $500,000 is enough coverage or not is something you have to figure out on your own, only because we are not aware of your debt and all the information necessary to come up with the coverage amount that best fits your situation. You honestly can’t protect your family if you don’t know how much you need every month, it isn’t worth guessing. If you die and your family gets $500,000 what can they do with it?

They may be able to invest that money and earn 5% which can amount to $25,000 a year in salary but if your family depends on more than $25,000 a year you need more coverage. Other times, your family will just pay off the mortgage and use the rest for however long it lasts.

This amount of coverage is also the most requested amount since it just makes sense to a lot of people. However, you should at minimum be getting 10 to 20 times your annual income for life insurance. From our experience, anyone who is making $80k or more per year should be starting at a $1 million dollar policy. You may feel like $500,000 is a lot of life insurance and in some cases, it can be but if you have 4 kids, stay at home partner and a big mortgage it won’t stretch too far. If you are on a limited budget then, of course, you simply need to buy the amount of life insurance that you can afford.

You do also want to keep in mind that if you’re going with an amount close to $500,000 like $350,000 or $400,000 for example. It may save you money by going for the $500,000 since life insurance companies have cost breaks that they offer in $250,000 increments. Just to give you an idea, you may be getting a term life quote for $400,000 with a monthly payment of $46/mo and that same company will give you $500,000 for $38/mo, so be sure to double check.

So as you can see this amount of life insurance can be perfect for some and not enough for others. However, in the next paragraph, we will explore why you don’t have to guess and show you how you can determine what you need.

How to find out your coverage amount?

The best thing you can do for yourself and your loved ones is to complete a thorough needs analysis which will help you determine if $500,000 is enough or not. The amount you gonna come up with will vary on your own personal situation. You can use our need analysis calculator to get a pretty precise idea of what amount of coverage to get. But let’s break down what you need to be looking at for a needs analysis:

- Income Replacement– First thing is you want to make sure that you’re replacing the income that you provide for your loved ones. Because this assumption involves you passing away we only need to calculate for about 60% of it. You can also subtract any other income sources like rental properties or social security your family would get from income needed.

- Debt– One of the biggest killers of American dreams is credit debt. So be sure to calculate all the debt you’d like to be paid off and add that amount to coverage needed. In today’s world it is quite common to speak with people who pay a few thousand dollars per month just for credit cards and student loans.

- Mortgage– This is an obvious one and probably the major reason people acquire life insurance so be sure to calculate the mortgage balance as part of the amount of life insurance needed.

- Final Expenses– In this section, you want to calculate how much money you’ll need to allocate for the funeral, final medical bills and legal fees. In our experience between $25,000 to $40,000 should suffice.

- College Expenses– Many Americans want to ensure that their kids can have a better life and the way to improve those odds is college. So be sure to allocate a 4-year tuition with living expenses for each child. For example, if you have four children $200,000 would be allocated just for that.

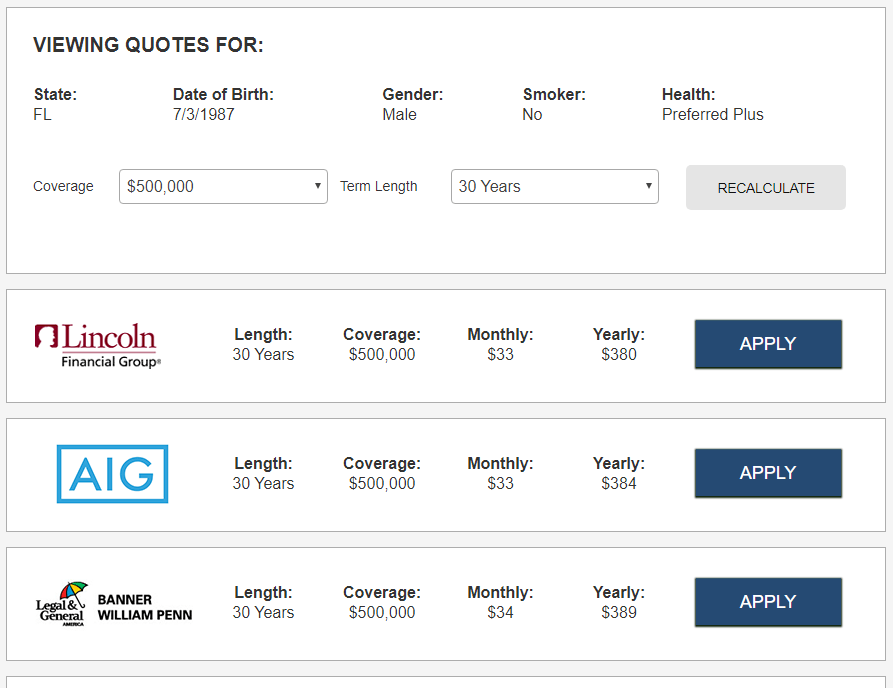

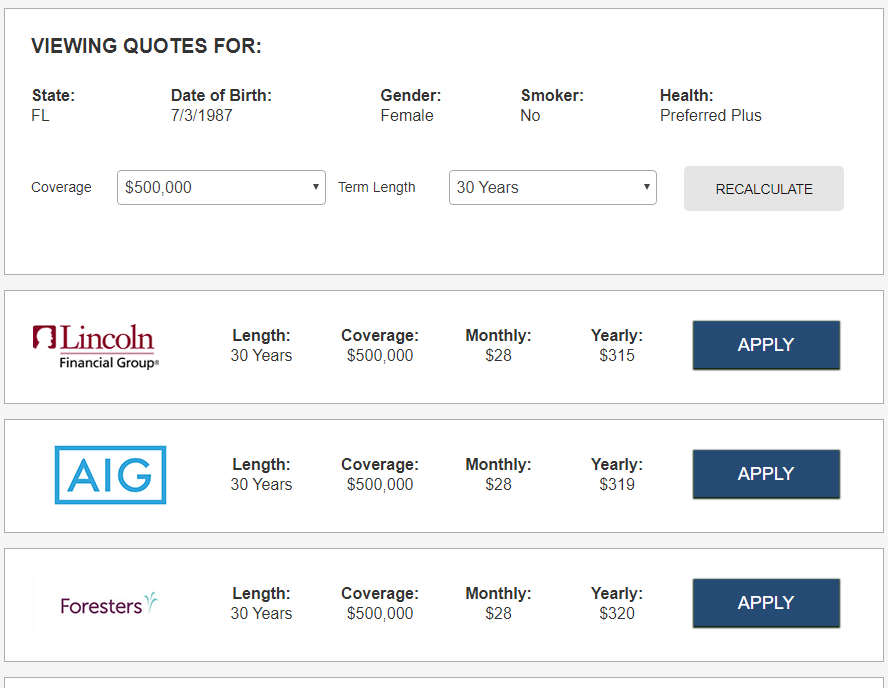

Sample Rates for $500,000 30 Year Term Life Insurance

To give you an idea we will use both male and female clients at age 30 that are non-smokers. As you will see females pay a bit less for life insurance than males due to a longer life expectancy.

Male 30 Year Old with Preferred Plus Health Class

Female 30 Year Old with Preferred Plus Health Class

Term life vs Permanent life

You also need to determine whether or not you want term life insurance or a permanent life insurance policy. You really can’t move on to the next step, your coverage amount, until you finish this step. Term life is a pure protection plan that will only cover you for a short time frame. Term life insurance is ideal for individuals who only need life insurance temporarily to fit their specific needs or don’t have a big enough budget for life insurance. Term life insurance is the cheapest life insurance type in the whole market which is why we said that if you’re on a tight income term life is for you.

Depending on which carrier you decide to buy a term policy you will be given choices of term lengths that you can remain covered for and they vary from 5, 10, 15, 20, 25, or 30-years. When your term policy expires you can choose to cancel the policy if you no longer need life insurance but keep in mind that if you choose to do this you will have to reapply whenever you do need life insurance again and you will not be given the same rate and quote as you receive this time because life insurance companies use your health, AGE, and lifestyle into consideration and those can change in a couple of years.

If you don’t cancel your term life policy it will automatically turn into an annually renewable policy which means that every year you choose to keep your policy you will be renewing your policy for another year but keep in mind that doing this will cause your premiums to increase every year! If your term came with a conversion option you can turn it into a whole or universal life plan.

Permanent life insurance has a couple different types of life insurance. Whole life is the first form of permanent coverage and is what most people hear about. This is the most simple of the kinds of permanent life insurances because it simply provides you with a death benefit and it even provides cash value as well as the other kinds. Universal life came after whole life and that’s why it offers a lot more flexibility and in many cases affordability. What we mean by flexibility is that you have the opportunity to change your premiums or coverage amount at any time of the policy because as you grow your needs will grow.

Work With Us!

Now you should have a pretty good idea if a half a million dollars will be enough or if you need to get some more. The most important thing to do when shopping for life insurance is to work with an independent agency that provides quotes from all the top rated companies like Prudential, Banner, Metlife and many more. You see life insurance rates are fixed by the law so why wouldn’t you let all the companies compete for your business.

This is also the reason why we offer no-obligation quotes from all the carrier in a matter of few mouse clicks right here on our site. Simply choose a product you’re most interested in and see who comes back with the best rate. So what are you waiting for, request an application or call us at 888.492.1967 and give yourself the peace of mind you deserve.