Most of the content out there regarding the topic of life insurance attempts to explain it by throwing around a ton of industry jargon with the expectation of “educating” people. Instead this just leaves consumer more confused and more afraid of making the wrong decision in purchasing a life insurance product. So in this article I will attempt to explain life insurance without using much(if any) industry lingo to help simplify what life insurance is and how to go about getting yourself insured. Let’s get started.

What is Life Insurance?

Life insurance is an insurance product that provides your family with money if you die and are no longer able to provide them with the income they are accustomed to. So if you have anyone in your life who is depending on your for money, it’s best to have a policy in place. This will help your family deal with not only the expenses that come with your death(like a funeral) but also replace the income they would lose if they lose you.

How Does Life Insurance Work?

It’s fairly simple, you pay a monthly payment to the life insurance company, and if you die, your beneficiaries, or the people listed to receive the money, will get the payout of your total coverage amount(aka death benefit). Basically your death benefit, or coverage amount, is the amount of money your financial dependents will receive when you die. If you no longer pay your premium(monthly payment) then the life insurance company will not be required to pay your death benefit. If the premium goes unpaid the policy will lapse, which means it becomes ineffective.

Types of Life Insurance

There are many types of life insurance products out there, but essentially it really comes down to two products. Those are permanent life insurance and term life insurance products. Let’s see the difference.

Term Life Insurance(Temporary Coverage)

Term life insurance is a life insurance product that is called temporary because it’s meant to protect you for a certain “term” period. It comes in forms of 5 year term, 10 year term and all the way up to 30 and sometimes 40 year terms. For example, if you purchase a 20 year term policy, your rate will be locked in for 20 years and will not go up or down in a level term product. If you die within the 20 years, your financial dependents will receive the money. However if the 20 year term expires and you don’t convert or renew the coverage, you’re no longer covered and will not be protected in the case of death.

Let’s use a hypothetical example to further simplify term life insurance.

Let’s say John Doe buys a $500,000 10 year term life insurance policy when he is 35. If he dies at 44, his beneficiaries(financial dependents) will receive $500,000. However, if he dies at 46 and did not convert his policy to a permanent one, then his family will not receive anything.

Basically term life insurance is good to protect against temporary financial risks like a mortgage, your kids college tuition, etc. Once you get older the need for life insurance changes. So if in 20 years your kids will be out of college and your mortgage will be paid off then a 20 year term policy for those amounts may be fitting.

Keep in mind most good term life insurance products come with an option to convert the policy to a permanent product. The downfall is that there will be a new price adjustment because of your older age at the expiration of the term period. And thats one of the major differences between term and permanent.

Permanent Life Insurance(Lifetime Coverage)

Permanent life insurance is exactly what it sounds like. It is a life insurance product that is designed to provide life insurance protection for your entire life. Depending on the type of product or company, it can range from coverage to age 90, 100, 121 or lifetime.

There are a few different types of permanent life insurance coverages but they branch out from either Universal Life or Whole Life insurance. Most permanent life insurance policies come with an investment aspect where a portion of your payment is used for an investment from which you can borrow down the line. This is known as “cash value.” The downfall of this is that these make the policies much more expensive than a policy built purely for death protection. The cheaper permanent option is a “Permanent Term” option, also known as Guaranteed Universal Life. This is the most affordable permanent life insurance because its more effective as life insurance protection rather than an investment.

Unlike term life insurance which is good for temporary financial responsibilities, a permanent life insurance policy is good for, you guessed it, permanent life insurance needs.

How Much Coverage Should I Have?

Overall there is a rule of thumb that you want your financial dependents to continue the lifestyle that you provide for them for about 10 to 15 years. So normally agents just multiply your annual income by 10 to 15 times. However there are other things to take into consideration. You want to make sure to calculate things like college expenses if you have kids, the final expenses that come with your death and any other cost that will fall on those that depend on you. The best way to figure out the coverage amount is to have a life insurance agent do a needs analysis for you, or simply use the Life Insurance Needs Calculator.

Figuring out the proper amount of coverage can be a difficult task but the first place to start is always what you can afford comfortably. To get the most amount of coverage for the best price it’s always best to shop around to make sure you don’t end up overpaying for coverage that you could have attained for a much better rate. That’s where working with a reputable independent life insurance agency is important.

How Do I Know When I Need Life Insurance?

When it comes to life insurance the only question you need to ask yourself is “If I die today, who will need my income to be replaced?” Whether it’s your parents, your kids, business partner or spouse, someone in your life will face a financial blow if you were to pass away. So if you lack the assets necessary to soften that blow, then life insurance is usually a good idea.

Is There a Qualifying Requirement to Buy Life Insurance?

Because life insurance has a lot of moving parts, the answer to most questions, like this one, is it depends. If we’re talking traditional life insurance policies then the biggest requirement will be your risk of death. The life insurance companies gauge your risk by looking at your overall health, background history and lifestyle.

The biggest factor that determines your qualification for life insurance is your health. The life insurance companies have health ratings classes that determine your rate. But if your health is in critical, or life threatening condition, you will be denied for traditional coverage. In these cases your only option would be a guaranteed issue life insurance coverage that is available without any health question or medical exams and is approved on a guaranteed basis. The higher the risk of dying, the higher the rate, or chance of denial. Unless you opt for a guaranteed issue product which should always be your last resort.

Other things that can effect your qualification is your avocation or background history. Often times if you’re still on probation for a felony you would have to wait for a year after completion to get coverage. Also if you participate in dangerous activities or work at a risky job like piloting, than there is a possibility of decline or increase in rate.

The Health Classes

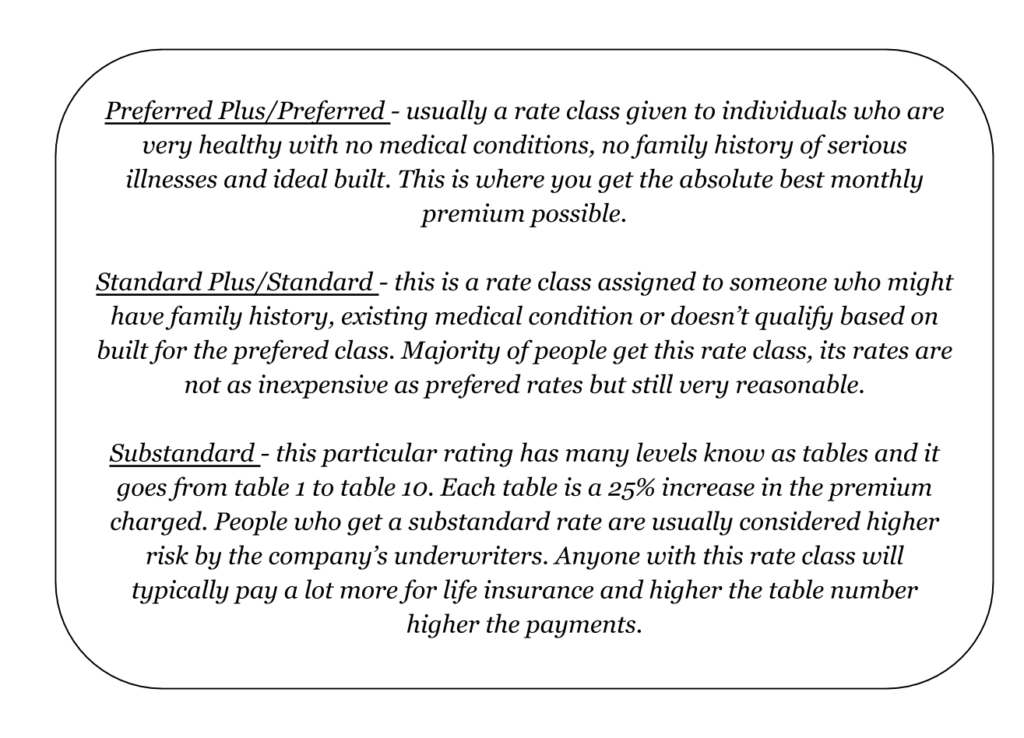

The health classes break down into rate categories. Those categories are Preferred Plus, Preferred, Standard Plus, Standard and Substandard classes. Here is a quick breakdown:

How to Buy

Now that you’re a little more familiar with what it is and how it works, you may be wondering how to actually attain a policy. The good news is if you go directly to the life insurance company or work with an independent agency(a broker) you will pay the same. The bad news is, this can leave you overpaying for coverage if you work with an agent that works with only one provider. So let’s discuss some important tips on how to get a life insurance policy, and how to get it at the best rate.

Shop Around

The key to purchasing a life insurance policy successfully is working with an experienced independent agent who has access to all of the life insurance companies on the market and shop on your behalf. If you’re perfectly healthy you can just use an online quote engine to run your quotes and simply pick the company with the best rate. However, if you participate in any risky activities or have and health problems, then you will want to recruit the services of an agent familiar with high risk clients.

This because in the case of being a high risk, the company with the lowest rate on the quote engine, may not necessarily be the company with the lowest rate for you. Certain companies weigh certain risks differently. For example, e-cigarette users will get smoker rates with 99% of the companies out there. This can double your cost of life insurance. However there is one company that insures that risk at a non smoker rate. And this remains consistent amongst different risks and different companies.

The Process

The life insurance buying process will involve 5 steps. These include:

- Shopping

- Application

- Medical Exam

- Underwriting

- Approval

Let’s discuss what you can expect during each step and how long the entire application process takes from start to finish.

Shopping Around – the first step is to shop around with all the companies on the market. As discussed earlier it’s best to get an experienced agent to do this for you. At this point you want to gauge the coverage amounts, product types and the cost for life insurance monthly. Always opt for an amount you can afford comfortably over a sustained period of time to avoid losing the coverage. It is always recommended to have a professional assist you after you have done your own research to ensure you’re working with someone reputable. The best way to tell if you’re working with an experienced agent is the pre qualification. Before the application every agent should pre qualify you for coverage in order to determine your rate class and the best company for your specific situation. The pre-qual should include lifestyle questions, health questions and family history.

Application – most applications have to be done over the phone with an agent. The good news is because of the digital age, there is no longer a need to drive to your local agent and most companies offer electronic applications. Because of this the application should take no longer then 10 to 15 minutes. The application will include questions about your health, family history and personal information such as social security number, drivers license number, etc. You will set up your beneficiaries and the medical exam will also be scheduled at this time and then it will be sent to you for electronic signature.

Medical Exam – the medical exam takes place at a time and place of your convenience. A nurse will come out to your home at no cost to you. The life insurance medical exam will be a lot like a usual physical. The nurse will take your blood pressure reading, collect a blood and urine sample, measure your height/weight and ask you a few questions. The medical exam can play a huge role on your rate so it’s important to get it right. To get the most favorable results it’s best to do it first thing in the morning while coming off a fast, prior to breakfast and coffee. These things can affect your readings. The whole exam shouldn’t take longer than15 to 30 minutes.

(There are options for a no medical exam policy)

Underwriting – this is the review process that the life insurance company does to determine your qualification for life insurance. During underwriting your application will be reviewed along with your medical exam results. Amongst this will be an in depth check into your medical history with the Medical Information Bureau(MIB) as well as a check into your driving history. This process can take anywhere from 6 to 8 weeks, and even longer if further information is required. However if you opted for no exam coverage vs traditional, then underwriting can be as little as a few hours or a few days.

Approval – once the underwriting is complete the life insurance company will come back with a decision. If you are working with a good agent then the approval should be fairly close, or exactly what you applied for. This is given that you didn’t keep anything form the agent or the company. At this point you will receive your policy in the mail, sign the delivery receipt, and enjoy the protection as long you pay for it.

That is the entire life insurance process in a nutshell, with rare exceptions.

Only an Overview

It’s always good to be armed with knowledge but in the end life insurance isn’t always the easiest of products to shop for confidently because of all the pre existing stigmas out there. That’s why there are life insurance agents/agencies. It is always good to work with a professional to help guide you through the process, just do your best to stay away from pushy salesman and marketing agencies masking as agents.

Start Here

The good news is you’ve reached your destination. InsureChance is on a mission to make life insurance simple. If you would like to shop for quotes you can use our quote engine with no personal information required and browse rates in peace. If you have more questions feel free to give us a call, hit the chat button below or leave us a comment. Welcome to InsureChance!