Understanding life insurance pricing can get tricky if you don’t know how it is determined. It doesn’t have to be if you understand how life insurance companies determine what risk class to put you in and how that affects your rates. In this article, we will cover all the different factors that go into determining your rate.

Understanding life insurance pricing can get tricky if you don’t know how it is determined. It doesn’t have to be if you understand how life insurance companies determine what risk class to put you in and how that affects your rates. In this article, we will cover all the different factors that go into determining your rate.

In summary, here are the life insurance health classes and what they are based on:

- Preferred Plus – perfectly healthy, no family history, or dangerous occupations.

- Preferred – overall perfectly healthy, perhaps family history, a little overweight or having a few recent speeding tickets.

- Standard Plus – mild health conditions, being overweight or quitting smoking about 12 months ago will land you in this category.

- Standard – you take more than one prescription but your conditions are stable.

- Substandard – if you have moderate to severe health or dangerous occupation you can expect to get substandard ratings. The substandard category has about 10 levels, each will increase the rate by 25%.

The factors that determine your rate include:

- Your Health

- Tobacco Use

- Your Build(Height/Weight)

- Family History

- Background History

- Dangerous Occupation

- Driving History

- Lifestyle

That’s the gist of it if you would like to get started and compare rates, use one of our quote engines to get a good idea of rates. Otherwise, let’s discuss each health class and how you can get the best rate.

The Rate Classes

Life insurance companies don’t like risk and do whatever they can to avoid it. That’s how they are able to insure your risk and this is why the health classes exist. Your rate will depend on the health class you fall in to during the underwriting process. This is when the life insurance companies review your medical exam results, dig through your medical history and check your background. The process can be quite extensive and no stone is left unturned. Once the underwriting is complete you will be assigned one of the following health classes. Let’s break them down:

Preferred Plus – A rating only extremely healthy individuals with no family history of cancer, stroke or heart disease can get.(applies to immediate family only) You’ll also have to have a clean background and driving record. You will also not have any dangerous occupation or hobbies.

Preferred – Similar to preferred plus but for people who may be slightly over the weight or have extremely mild medical conditions.

Standard Plus – Just like preferred rate you are overall considered to be a good risk with this class but take two or more medications for mild conditions.

Standard – The standard health class is where the less healthy applicants fall in. In this case, you may have a moderate condition or multiple factors on top of each other, you will into the standard category. Other factors that can rank you standard is being overweight, having less than perfect background or hazardous occupations.

Substandard – You’re either extremely overweight or have moderate to severe medical conditions that affect your daily living. You may also get this rating if you have a dangerous hobby or occupation like a ship wreck diver for instance.

The Substandard category has 10 levels known as tables. They go from 1 to 10 each going up by 25% on your premiums. The table you fall under will depend on the severity of your risk. So if you’re a substandard table 1, you would pay your standard rate plus 25% on top. At table 2 it’d be 50%, table 3 75% and continues in that fashion until table 10.

Smoker Rates

If you use tobacco products you can expect a 60% increase or more in premium of whatever rate you fall in to. Smoking increases your risk rating to the life insurance company, especially if you have health conditions. Some carrier like Prudential have exceptions for non smoker rates for non cigarette tobacco use in the form of e cigarettes, tobacco chewing, and occasional cigar smoking. To qualify for non smoker rates in general you would have to have been tobacco free for at least 12 months and test negative for nicotine on your medical exam.

Cost Examples

So now that we know a little about each class, let’s look at a 45 year old male and run some quotes for him at each rate, then pick the most affordable company for each.

The product we are running quotes for is a $500,000, 20 year term life insurance policy.

- Preferred Plus – $30 a month with Protective

- Preferred – $39 monthly with Protective

- Standard – $52 a month with Transamerica

- Standard Plus – $62 a month with American General

- Substandard Table 2 – $77.35 with American General

Smoker Rates

- Preferred Smoker – $130 with Transamerica

- Standard Smoker – $174 with Transamerica

That’s a quick rate break down. As you can see the rates can vary from class to class and company to company. This is why it will be key to work with an independent agency that knows which company will provide you the most favorable outcome for your unique situation.

How Life Insurance Companies Determine Your Rate

As mentioned, life insurance companies weigh many factors to determine your rate. Let’s talk about what they look for when reviewing your application.

Health

One of the biggest factors in what rate class you get. The underwriter will want to know what your health looks like. Are there any medical conditions? And if so what are you doing to treat them. They will also look at your doctors records for length and severity of the health problems.This will help decide if your medical conditions are life threatening or not.

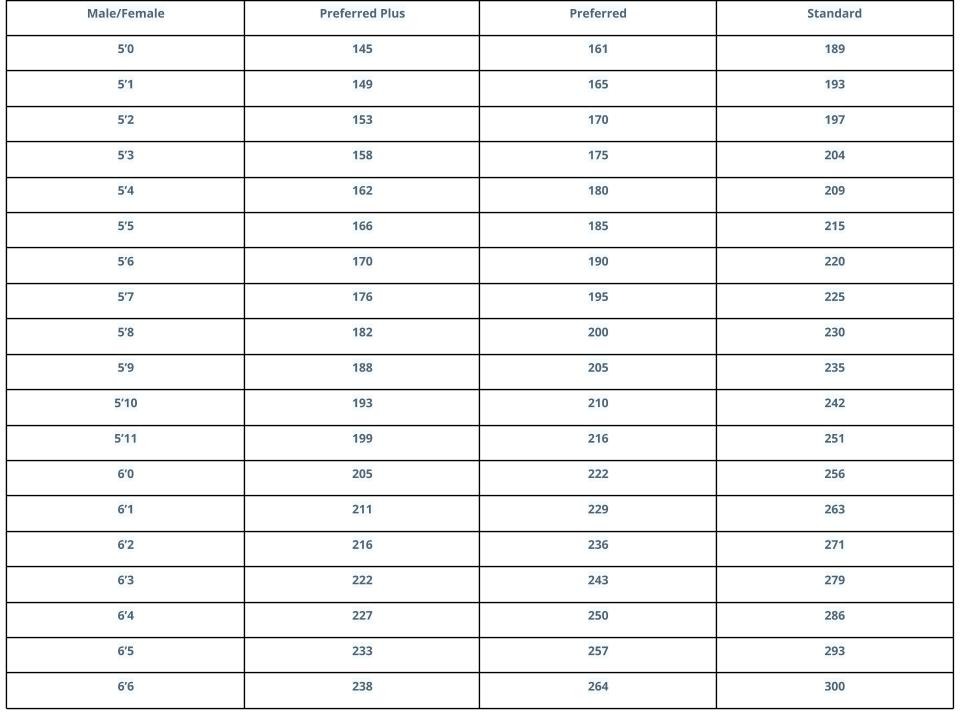

Build

Because a bigger health risk comes with being overweight/underweight, life insurance companies use build charts to determine your rates. These are mostly black and white but can vary form company to company with different cutoffs. Even if you are pregnant the life insurance companies won’t give you a break for the extra weight. Here is a sample of the chart to give you an idea.

Family History

Family History

Here, the life insurance companies just want to know if you’ve had early death in your family due to serious illness. If there is a history of heart disease or cancer before age 60, you can expect to get a rate class below what you expected to get.

Background

The underwriter will look into your background history to see if you qualify for coverage. Usually if you have a felony, you’d have to wait a year or two, post probation to qualify for coverage. They will also look at your driving record and make sure any poor financial history, like a bankruptcy is discharged to qualify you.

Hazardous Occupation or Hobby

If you participate in any dangerous activities the company wants to know every detail possible. What is the activity? What is the frequency of the activity? Where does it take place? What is your experience like? And more pertaining to each possible hazard. In the case of a dangerous sport or job, you will get charged a flat extra. This is a surcharge per every thousand dollars of coverage. The flat extra usually ranges from $2 to $15 dollars. Remember this is an addition to your annual premium. So aside from getting rated up, you will be charged a flat extra for the extra risk.

Lifestyle

This will be a huge factor if you’re in the high risk health category. The life insurance company will want to know that you are following a good treatment and living a lifestyle that favors your medical condition. Things like smoking when having sleep apnea will hinder your chance of getting approved. However, making it evident that you exercise and eat a healthy diet can increase your odds of approval at a better rate. Usually your life insurance agent should add a cover letter detailing your lifestyle.

How to Get the Best Rate

Life insurance companies use statistics to determine rates, so for the most part it can seem black and white. However, each company weighs risk differently because each company has a different pool of clients. Due to this, each company changes it’s “high risk niche” from time to time. For example, one company may decline a type one diabetic, and another will provide coverage. So if you’re a high risk, the quoter is not a good place to start.

Another thing you should do is work with an independent life insurance agency. This way you can compare rates with multiple companies and get the one that will provide the best rate for your condition. As you saw from the rate examples, the company with the best rate can vary from class to class. Make sure to be 100% honest with your agent so that they can evaluate your risk prior to applying with a company. Any agent that doesn’t ask you the difficult questions isn’t experienced enough to be working on your application.

If you’re totally healthy or have some major medical conditions and consider yourself high risk you should definitely work with an independent life insurance broker. See, life insurance rates are fixed by the law and each company will look at you differently. That’s why you need to shop around and try to get the best plan based on your qualifications. Here at InsureChance, we work with over 60 top rated insurers to help you find a plan and our service is absolutely free for you. Thank you for reading and we look forward to helping you secure a great life insurance policy!