If you’re wondering what Lincoln Heritage Funeral Advantage program offers then you came to the right site! We are an independent life insurance marketplace that educates and helps consumers find the best life insurance plan. The Heritage Funeral Advantage plan is a form of life insurance known as a final expense plan. Final expense is a whole life policy that individuals over the age 50 typically buy to cover expenses associated with dying like funeral cost, final medical and administrative bills. Now, there are a lot of final expense options on the market but we’re reviewing Lincoln Heritage product so let’s dig deep into the carrier’s history, product benefits and what you should be looking for. Here is a quick summary:

If you’re wondering what Lincoln Heritage Funeral Advantage program offers then you came to the right site! We are an independent life insurance marketplace that educates and helps consumers find the best life insurance plan. The Heritage Funeral Advantage plan is a form of life insurance known as a final expense plan. Final expense is a whole life policy that individuals over the age 50 typically buy to cover expenses associated with dying like funeral cost, final medical and administrative bills. Now, there are a lot of final expense options on the market but we’re reviewing Lincoln Heritage product so let’s dig deep into the carrier’s history, product benefits and what you should be looking for. Here is a quick summary:

- They really only offer one type of life insurance product which if their final expense insurance, hence the name “funeral advantage”.

- Lincoln Heritage is a highly rated company who have been around for quite some time. They are known for their amazing customer service and the fact that they are a small company is another pro of theirs.

- A con of Lincoln Heritage is that they only offer funeral insurance, they don’t offer term life, whole life, or any universal life insurance products. Another con is that their program offers no medical exam this may be more expensive than other policies who do require a medical exam. Lastly, they are just another company among many others.

About Lincoln Heritage Insurance Company’s History

Lincoln Heritage Funeral Advantage Insurance Company has been around since 1963 when it’s founder decided to go after the final expense industry. The company kept adding family members to their operations and grew quickly. After 3 years in business, the company got bought out by Londen Insurance Group and continued expanding. By 1987 they had about 100, 000 policies active on the books and about $10 million in premiums. In 1994, the company opened its well known Londen Center with a goal of future expansion. Right after that move the company jumped to $25 million in premium sales and by 1996 had about 250k policies on the books. The company continues growing every year and don’t think they will stop doing so.

Lincoln Heritage Funeral Advantage Insurance Company 2017 Review

Lincoln Heritage Funeral Advantage Insurance Company is the biggest provider of final expense life insurance. The carrier does business in all the states and has over eight hundred thousand policies in force and they are valued more than $6.59 billion. Lincoln Heritage company mission became to set a new bar for improving overall standards by providing prompt friendly service and offering the best types of life insurance policies to be able to meet all the needs of individuals who want to leave memories not bills to their loved ones once they pass. The company has an “A-“ rating from A.M Best and “A+” from BBB.

Lincoln Heritage Funeral Advantage Life Insurance Product

Like we mentioned in their review, Lincoln Heritage is one of the top leading providers of Final Expense Insurance. Since this is true, they really only offer one type of life insurance product which if their final expense insurance, hence the name “funeral advantage”.

The Funeral Advantage Program

A great product for individuals between ages of 40 to 85 that can secure a whole life insurance policy without a ton of questions or a medical examination. This program also works great for people that have pre-existing medical conditions. The program also comes with Family Support Services at no charge which gives you a personal concierge representative to help your family deal with the loss of the loved one.

Just like most whole life final expense coverages this plan is limited at $20,000 per policy. However, if you need more coverage than that there are plans available with higher amounts.

- Those with health issues can still be covered.

- Cash benefits are paid within a few days once the claim is processed.

- Your monthly premiums are locked in and will stay fixed.

- $100,000 additional benefits in case your death is caused by accident.

- These services are perfect for individuals that are primarily concerned about final expenses like funeral cost and any other last bills.

Pros and Cons of Lincoln Heritage

Lincoln Heritage is a highly rated company who have been around for quite some time. They are known for their amazing customer service and the fact that they are a small family owned company is another pro of theirs. A con of Lincoln Heritage is that they only offer funeral insurance, they don’t offer term life, whole life, or any universal life insurance products. Another con is that their program offers no medical exam this may be more expensive than other policies who do require a medical exam. Lastly, they are just another company among many others.

Are there better options?

Although their final expense program seems to be pretty solid and the company itself is very reputable you may have alternatives. When it comes to life insurance no one company will have the best rate for every single individual. That’s why you should always shop around to see whats available out there. There are a lot of final expense life insurers out there so don’t go with the first option you find. Oh and before we forget to mention that you can actually get more coverage than $20k that Lincoln Heritage is capped at.

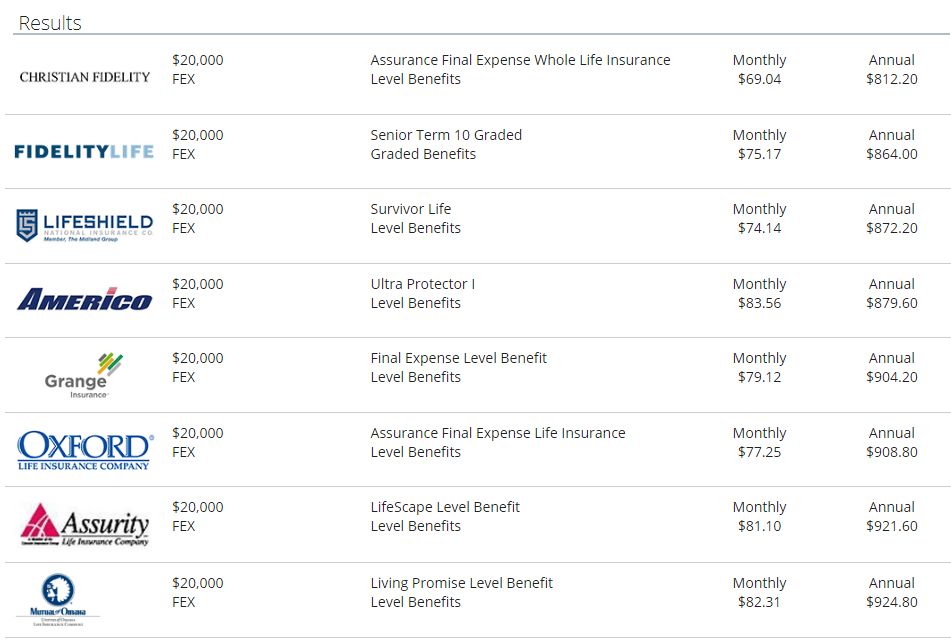

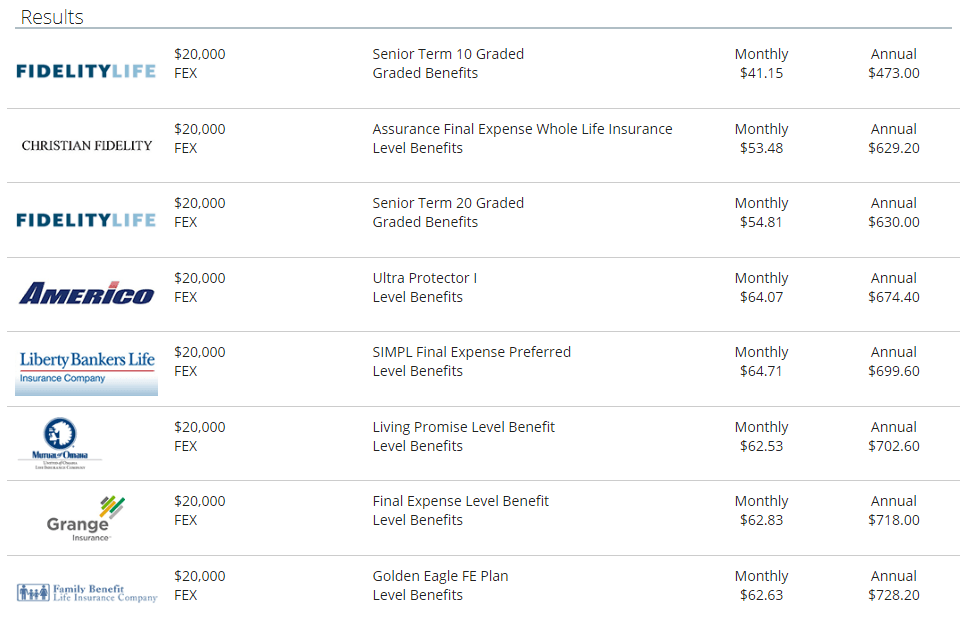

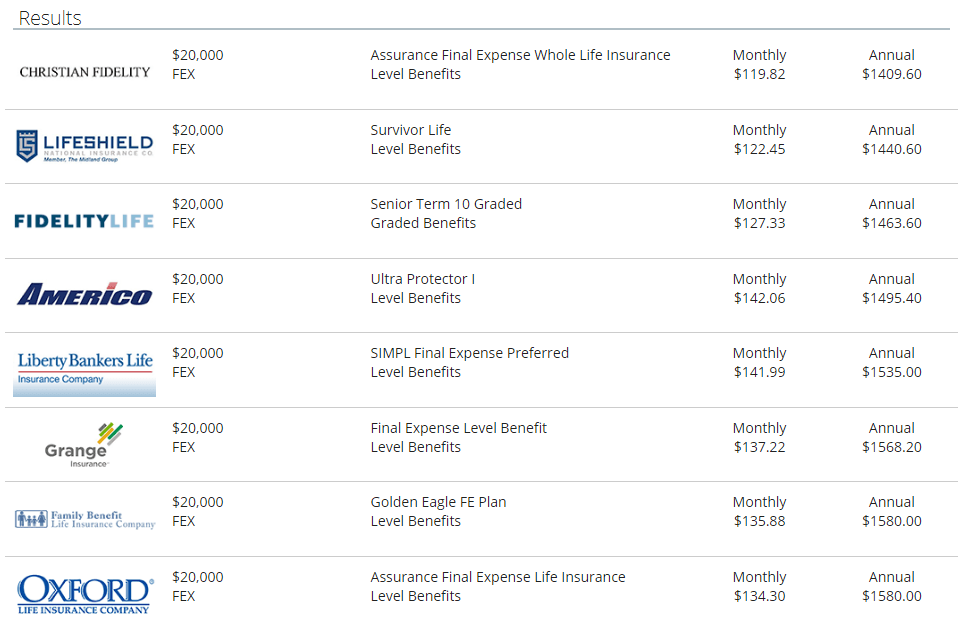

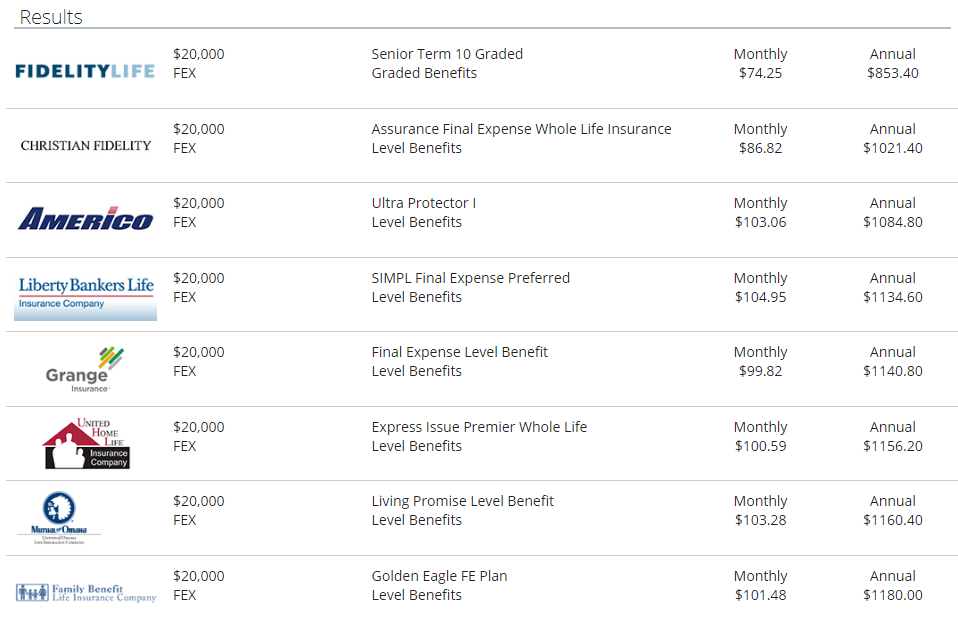

Here are some sample rates for $20,000 of coverage for ages 50 and 60 with some of the companies we represent.

Male Age 50

Female Age 50

Male Age 60

Female Age 60

Another big thing that people miss out on when looking for the final expense is not going with a more underwritten life insurance option. For instance, if you’re in good health you can secure a policy for $50,000 or $100,000 by paying almost the same thing you would pay for a final expense plan. This type of policy is known as Guaranteed Universal Life and it offers much better rates for a lifetime plan.

Work with Us!

If you were simply wondering if your premiums are safe with Lincoln Heritage the short answer is Yes! The company is outstanding from their rating to their reputation, their products are pretty great too. This doesn’t mean you should just jump in but rather you should research other top companies and see what else is available out there. Here at InsureChance, we work with over 60 companies, some of them are traditional plans others final expense coverages. We will also ensure that your entire application process is flawless from begining to the end. So don’t wait and call, chat or email us today!