Whether you just want the ease of finding your ideal policy online or you don’t want to deal with the in-person process, it’s understandable why you would want to buy your life insurance online.

Whether you just want the ease of finding your ideal policy online or you don’t want to deal with the in-person process, it’s understandable why you would want to buy your life insurance online.

Securing a life insurance policy online has never been easier and more companies are offering digital ways of getting life insurance. In most cases securing a life insurance online can result in you getting a much better deal especially if you are working with a broker.

Purchasing a life insurance policy online is no different than buying anything else online but let’s review some steps you should take.

1. Figure out What You Need

First of all, you need to know what kind of life insurance you’re interested in. There are many different types of policies, a lot of which are customizable with riders. The cheapest and by far the most popular life insurance is term life, which provides you a period of coverage for a very reasonable cost.

With term life, you’ll apply for coverage usually between 10 and 30 years long. During this set period, the life insurance carrier guarantees the payment of your death benefit so long as the policy premiums are paid. If you were to pass away during the active term of this policy, your beneficiaries will receive a check for the amount of death benefit you selected at the time of application.

After the expiration of the term period, your coverage will renew on an annual basis, but many customers find the prices of this extended coverage to be far too expensive. That’s why conversion options exist. With a life insurance conversion, you can alter your term policy into a universal life or whole life policy offered by the same carrier. Although your policy will be new, you’ll still be dealing with the same carrier as before.

A universal life or whole life insurance policy provides lifelong coverage. As a general rule, this type of insurance is more expensive, but converting from a term policy allows customers to get the best of both worlds. You can play around with an online quoting engine to see what types of coverage are available and about how much they might cost.

In most cases, people under the age of 40 who are starting a family opt-in for term life because they can secure a large amount of coverage with a low monthly premium. Others, who have few or no dependents and are a little older prefer to go with lifetime plans to leave behind a legacy, cover funeral expenses or cover estate taxes for high net-worth individuals.

How Much Do I Need?

This is a very difficult question for many people to answer. Unfortunately, too many people underestimate the amount of life insurance coverage they need. Although policies with lower death benefits tend to be cheaper, these smaller amounts generally aren’t enough to support a family beyond even one year. Certainly, life insurance is a popular way to replace income, but it’s not the only reason that a person might get life insurance. If you have a mortgage, debts to pay off, or if you are planning on sending your children to college, life insurance can be the backup plan to pay for this.

When asked, most people want to ensure that their family will be set at least for several years if something were to happen to a breadwinner in the family. Working with a knowledgeable life insurance agency makes it easier to understand exactly how much coverage you’ll need. An experienced agent will conduct a needs analysis to determine exactly how much life insurance you need. You can also do a quick calculation yourself with our needs calculator. Another popular way is to follow the rule of thumb by simply multiplying your annual income by 10 to 15 times to come up with a face amount.

Just as lower death benefits are connected with lower premiums, cheaper term lengths can be less expensive, too. Many people turn to term insurance as a way to protect them during their working years, thinking that by the time a 30-year term policy is up, they won’t have as many financial needs. This is one of the primary reasons that term life insurance policies are so popular today. You’ll want to select a policy that is most closely aligned with your needs.

What Will Affect My Premiums?

Age, gender, and health history are the three primary ways that a life insurance carrier calculates premiums. Life insurance carriers are adjusting their rates all the time, but a good life insurance agent will work with a number of highly qualified carriers that all offer a solid value. Different carriers tend to treat medical issues differently, so it’s important to know before you apply with a certain carrier whether they will even consider applicants with significant past medical history, like cancer. A good agent or agency will be able to tell you who they recommend submitting your application to.

Carriers provide life insurance coverage at different rate classes, the top class usually being called preferred or preferred best. Getting this coverage generally requires near-perfect health and good height and weight. Don’t assume that recently lost weight or a kicked smoking habit in the near past will dramatically adjust your rates, either. Many carriers require 1-2 years of weight loss stability and the same period of staying away from smoking.

You might be better off waiting a few months to qualify for the higher rate. On that note, you should not attempt to lie about any medical history or your smoking use. Carriers use paramedical exams with blood and urine tests to verify accuracy, and they can even review your medical records further along in the application process. Finding out that you haven’t been truthful can lead to an outright decline, so it’s better off, to be honest up front and get information from your insurance agent about what they recommend.

2. Shop Around with a Broker

Now that you know the type and amount of life insurance you need, it is time for one of the most important steps. Shopping around for life insurance is the key to not only getting the best rate but also making sure that you get approved if you have any preexisting conditions. To your luck, I’m here to tell you that shopping online is the best way to ensure this, just make sure you work with an independent agency that has an ability to provide you with online quotes. In our experience, we have seen clients save $100’s and $1000’s every year by comparing rates with other companies after getting an initial quote from a local agent.

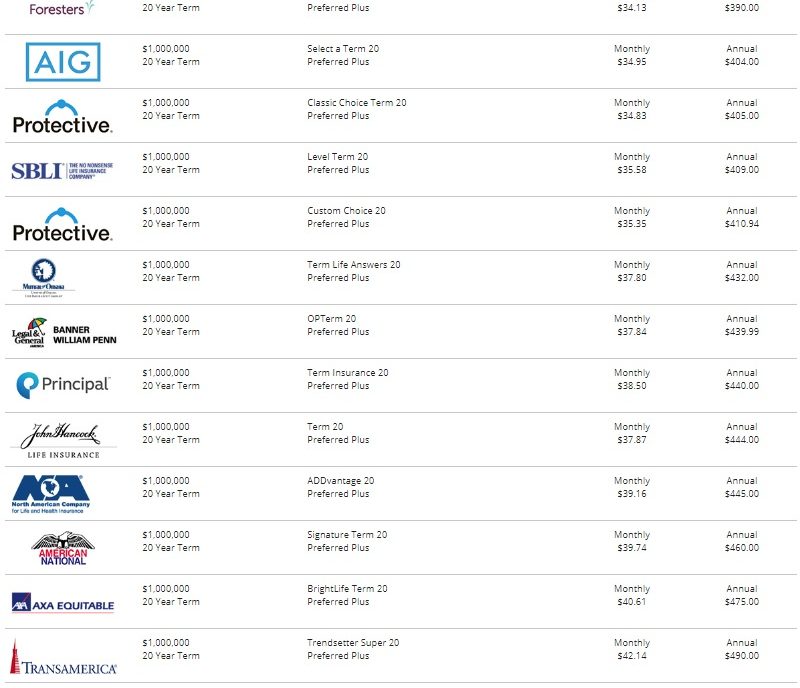

Life insurance companies change their rates all the time and based on your individual factors one company may be the best for you and the worst for the next person. Just to give you an idea of what the quotes look like, here is an image of the results you’ll see when you fill out the information on one of our quote engines.

If you’re curious this is a quote for a 30 Year Old Healthy Male who is interested in a $1 million dollar 20 Year Level Term Policy. When you pick the best plan from the quote that leaves us with third and final step below.

3. Start the Application Process

The last step is to get the application started and once again your agent can help you with the entire process. It is important to note that there are two types of applications for life insurance. One is the traditional one with an exam and the other is the simplified issue application.

With a traditional exam plan, you’ll have to complete a full application with a series of questions pertaining to your health, lifestyle, family history and driving history. In addition to that, you’ll be required to have a nurse come out to your home to complete a paramedical exam where they will measure your build, blood pressure and pull a blood/urine sample. Once this is complete the life insurance company will take about 4 to 6 weeks to come back with a decision after reviewing your application and going through all different records of yours.

The simplified issue right is a lot less tedious and in most cases preferable by individuals who don’t mind paying a little more. A simplified issue application is completed online with fewer questions and the ability to skip the exam altogether. Once the application is submitted to the company, you’ll get a response within 72 hours with most no exam carriers and in some cases, your policy will be delivered via email. For most people who are looking to purchase life insurance online, the simplified issue is the way to go.

Let Us Help!

Here at InsureChance, we work with over 60 top rated life insurance companies and we have decades of experience. We will give it our all to ensure that you’re getting the right type of life insurance at the best rate. Call us at 888-492-1967 or Get a Quote Online.