You have every other type of insurance protection like auto, home, and health but recently realized that you are either uninsured or underinsured in the life insurance department. As you want on your journey of looking for life insurance you stumbled upon Royal Neighbors Life Insurance Company and are curious if this is the best life insurer for your family. In this article, we will cover their history, products, ratings and even their charitable contributions. For a quick summary read below otherwise let’s dive in.

You have every other type of insurance protection like auto, home, and health but recently realized that you are either uninsured or underinsured in the life insurance department. As you want on your journey of looking for life insurance you stumbled upon Royal Neighbors Life Insurance Company and are curious if this is the best life insurer for your family. In this article, we will cover their history, products, ratings and even their charitable contributions. For a quick summary read below otherwise let’s dive in.

- The company is inching near a 1 billion dollar mark for total assets that they allocated.

- Royal Neighbors offer a nice array of life insurance products such as term life, whole life, and universal life to hit everyone’s different taste.

- According to A.M Best, they have rated Royal Neighbors of America an “A-” which happens to be the fourth best rating you can possibly be given by A.M Best.

- You should always want to read a company’s rating because it will give you an idea of their financial stability.

- Term life is an ideal plan for short term protection ranging from 1 year to 30 years.

- Whole life is a form of permanent life insurance and provides coverage for you guessed it, your WHOLE life!

- Universal life is another form of permanent life insurance and does provide coverage for your entire life but it also allows for flexibility.

- Regardless if you decide to buy coverage from Royal Neighbors Life Insurance Company or not you should still consider shopping around for quotes. You will never know what you can get offered with other companies. Life insurance is not a one size fits all kind of thing and you should always look at all the options you have.

Royal Neighbors Life Insurance Company 2017 Review

Knowing a company’s assets is a good thing because it means that they have the money there to pay out your policy when your family needs it the most. Royal Neighbors offer a nice variety of life insurance products like term life, whole life, and universal life to hit everyone’s different taste. According to A.M Best, they have rated Royal Neighbors of America an “A-“ which happens to be the fourth best rating you can possibly be given by A.M Best.

Importance of the Rating

The rating a life insurer gets tell you an overall picture of that company’s financial health. A financial health of the company is probably the most important factor you should be looking at because it determines if they can survive financial hits. These hits can be a large number of claims or simply a recession. In every article where we do a review, we like to cover the importance of these ratings since this is probably the most important part of choosing a company.

Royal Neighbors Life Insurance Company’s Products

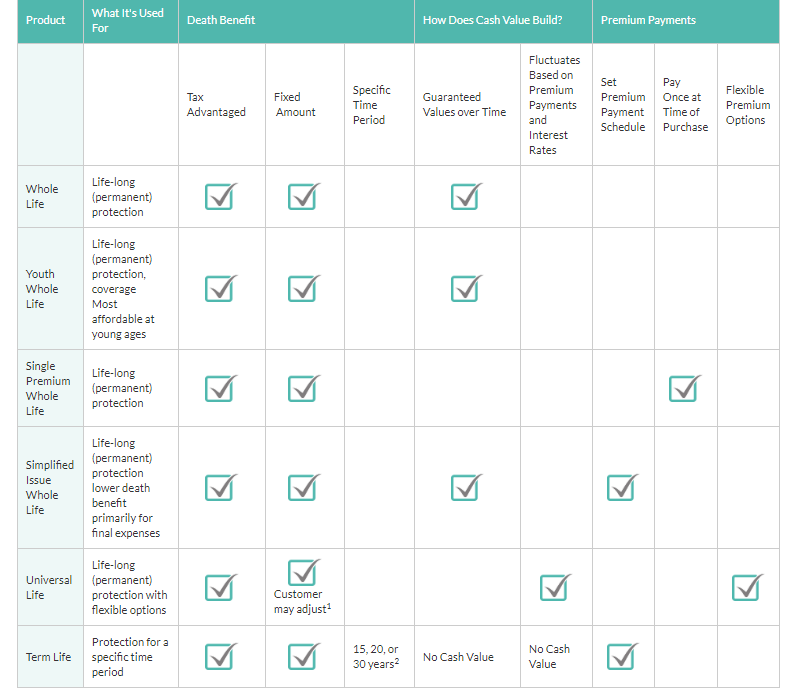

Like we mentioned before, Royal Neighbors Life offers term life, whole life, and universal life insurance policies.

Here is a cool product breakdown from Royal Neighbors Website:

Term life insurance

- Term life is a short term plan with very affordable monthly premiums.

- Since a term life policy is for only a temporary period of time, you get to choose how long you want it for.

- This plan offers you coverage from 10 years to 30 years.

- Term life insurance is dirt cheap and anyone can afford it.

- With this standard term life policy, your premiums will be level and same with your death benefit which means that it will never increase nor decrease.

- Riders available with this policy are Disability Waiver Rider, Accidental Death Rider, Guaranteed Insurability Rider, Accelerated Death Benefit Rider, Children’s Rider, Cancer Waiver Rider.

Whole Life insurance

- Whole life is a permanent plan designed to keep you covered until age 100!

- While your cash value is growing it can also be accessed through loans.

- Keep in mind that if you borrow against your policy or take out a loan from your policy’s cash value you will have to pay it all back.

- With whole life insurance, you have a couple options available, you can choose a traditional whole life, the simplified issue whole life, or the single premium whole life policy.

- Your premiums with whole life are a level which means they will never go up.

- Whole life insurance is a little more expensive because it offers life long coverage and cash value build up, term life doesn’t do either.

- You can opt out to complete your payments in 20-years, pay only to 65, or pay a lower premium for the rest of your life.

- The simplified issue doesn’t require a medical exam but is capped at $25,000.

- With the single premium whole life option, you can choose to pay the entire premium up front and you will receive a discount for paying up front.

Universal Life Insurance

- Universal life similar to a whole life plan since it also provides lifetime cover with more flexibility though.

- This product offers locked in rates so you won’t have any surprises in the future with rate increases.

- Unlike other permanent plans, you can pay more or less for your premiums.

- You have an option of getting your family the death benefit plus cash value accumulation.

- A universal life plan will accumulate cash value so you can supplement it with your retirement income.

- Universal life insurance is a good way to make investments and earn cash value quicker than a whole life insurance policy.

- There is a 20-year no lapse guarantee but has a much smaller guarantee than other companies.

- There is also a 2% minimum crediting rate but it’s also lower than their competitors.

Work with us!

Now that you got this far you have a nice idea of what this great company has to offer! But if you’re still wondering if this is a good company for you the answer is, YES! However, there are more robust companies with similar or lower rates like Banner Life, Prudential and others. So before deciding on this company we highly advise you put them to a test against the entire marketplace. How can you get this done? Well, you have come to the right place because we allow you to compare rates with all the top rated companies with a click of a mouse. If you’re interested in term life insurance comparison click here and here for permanent life insurance. Here at InsureChance, we work with over 60 top rated insurers and will do our best to get you an ideal plan for your family. Besides letting you compare we specialize in high-risk underwriting, smooth application process, prequalification and drafting expert cover letter. All this is done so you can relax while we get your policy delivered into your hands. So don’t wait and call us today at 888.492.1967! Welcome to best online life insurance marketplace.