Ready to jump on the term life insurance train? There are reasons why it’s the most popular form of life insurance out there: it’s easy to understand, it’s affordable, and it’s the best type of protection for you and your family. Let’s take a look at some common features of term life insurance and the quotes linked to it.

How Rates Are Determined

State laws have a role in life insurance products, since carriers can’t actually offer a product in the state until the insurance commissioners have had the opportunity to review all of the details and officially approve it. As a result, you can rest assured that there is some oversight in this whole process. Carriers also use several other factors to determine life insurance rates, including your age, smoking status, and overall health. When you fill out some basic quote information, the carrier will ask for how you might rate yourself. It’s common to think that you might be a preferred best risk. The reality is that many people don’t quality for preferred best rates and it’s an industry joke that these are “walk on water” rates. You’ll need to be in a good height and weight class and have no major health issues to quality for this rate. The older you are, the harder it is to qualify for this rate, which is why it’s to your benefit to get your insurance as soon as possible.

When you apply for life insurance, the carrier will review all of your information, including your paramedical exam results, to determine your rate class. Sometimes you can even qualify for a rate class better than what you applied for, although the carrier also has the right to review medical records to determine if you might be at a lower risk class. Many people would qualify for a standard or standard plus risk class, although with better health you might be able to get a better rate.

One common question is how much coverage you should get. Although a smaller policy might be appropriate if you are only concerned about funeral and burial costs, many people come to the table with concerns about how their family would be able to afford bills and expenses. A good guideline that some people use is ten times their annual income, although you should factor in other aspects, too. If you have a mortgage or other debts, for example, you’ll want to add that in to your overall insurance benefit. If you want your children to be able to attend college, too, consider those costs to add in to your insurance benefits.

Let’s Take a Look at Some Sample Quotes

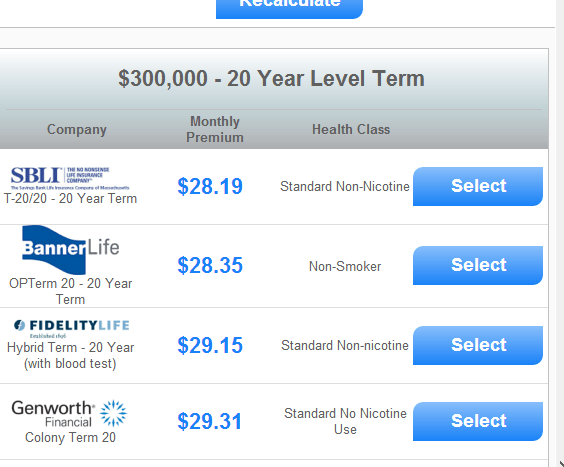

Meet Samantha. She wants to get $300,000 in protection based on her annual income and she is aged 35 with standard health. She’s had a scare with cancer about ten years ago, but all of her lab work and follow up appointments indicate that she is in good shape. She’s applying for a standard rate based on her clean bill of health.

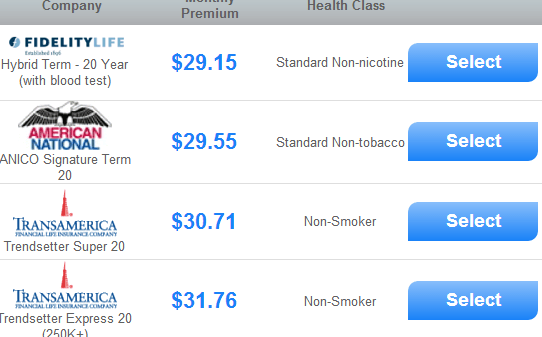

Look at that! For less than $30 a month she can get coverage for $300,000 to protect her family. As you can see, she has her choice among multiple different carriers. Let’s say, though, that she doesn’t want to go through the process of getting a medical exam. She thinks it will take too much time and she’s afraid that the carrier will simply be looking for a reason to give her a table rating.

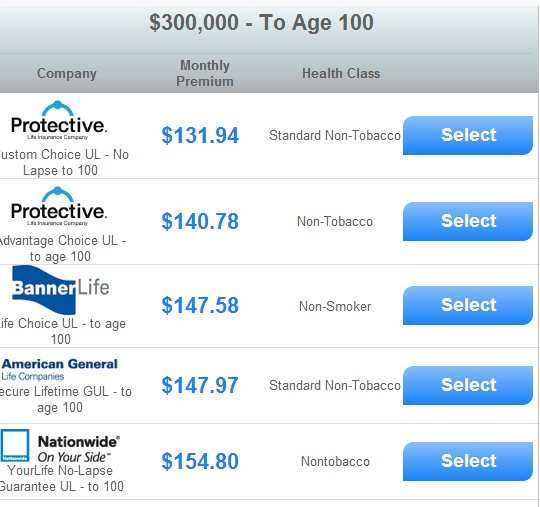

Now that she has this to compare, let’s say she wants to see how much it might cost to get a similar policy with universal life.

As you can see, permanent life insurance is more expensive, but it’s also guaranteeing your coverage all the way until age 100 in this scenario. If you want to lock in coverage in the event that you develop a health issue later on, she is certainly smart if she decides to get her coverage now as opposed to later.

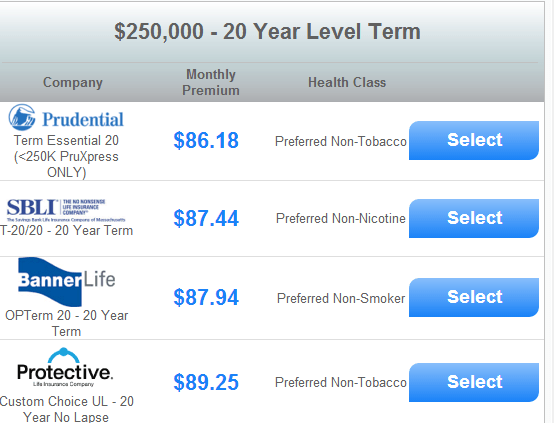

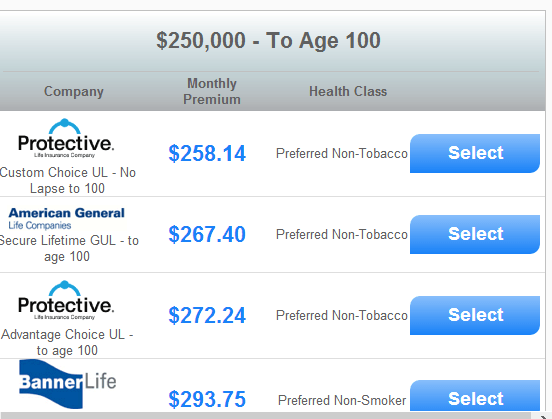

Now let’s take a quick look at Don, a 55 year old who wants $250,000 in coverage. He’s in really great health, so he’s a preferred best risk.

Even though Don is in great health, his insurance at age 55 is more expensive than Samantha’s coverage at age 35. Now you can see what a big difference it makes to get your coverage early on. Let’s explore the same interests in a policy with him in a universal life policy.

Although this is more expensive, perhaps Don wants to lock in coverage for the rest of his life and not have to worry about what might happen if his term coverage expired. As you can see, playing around with your life insurance quotes is a good way to figure out the most appropriate coverage amount for you. You can also save some money by paying on an annual basis, but many people find the convenience of paying on a monthly basis. Age and health can have a significant impact on what you end up paying for your coverage. The bottom line is that if you are healthy and young, you need to invest in your coverage right away.

If you have any questions call us 888-492-1967 or get a quote online.